Why Finding Dental Insurance That Covers Veneers Is So Challenging

Dental insurance that covers veneers tends to feel like a myth. Most plans label veneers as purely cosmetic, which usually means 0 % coverage.

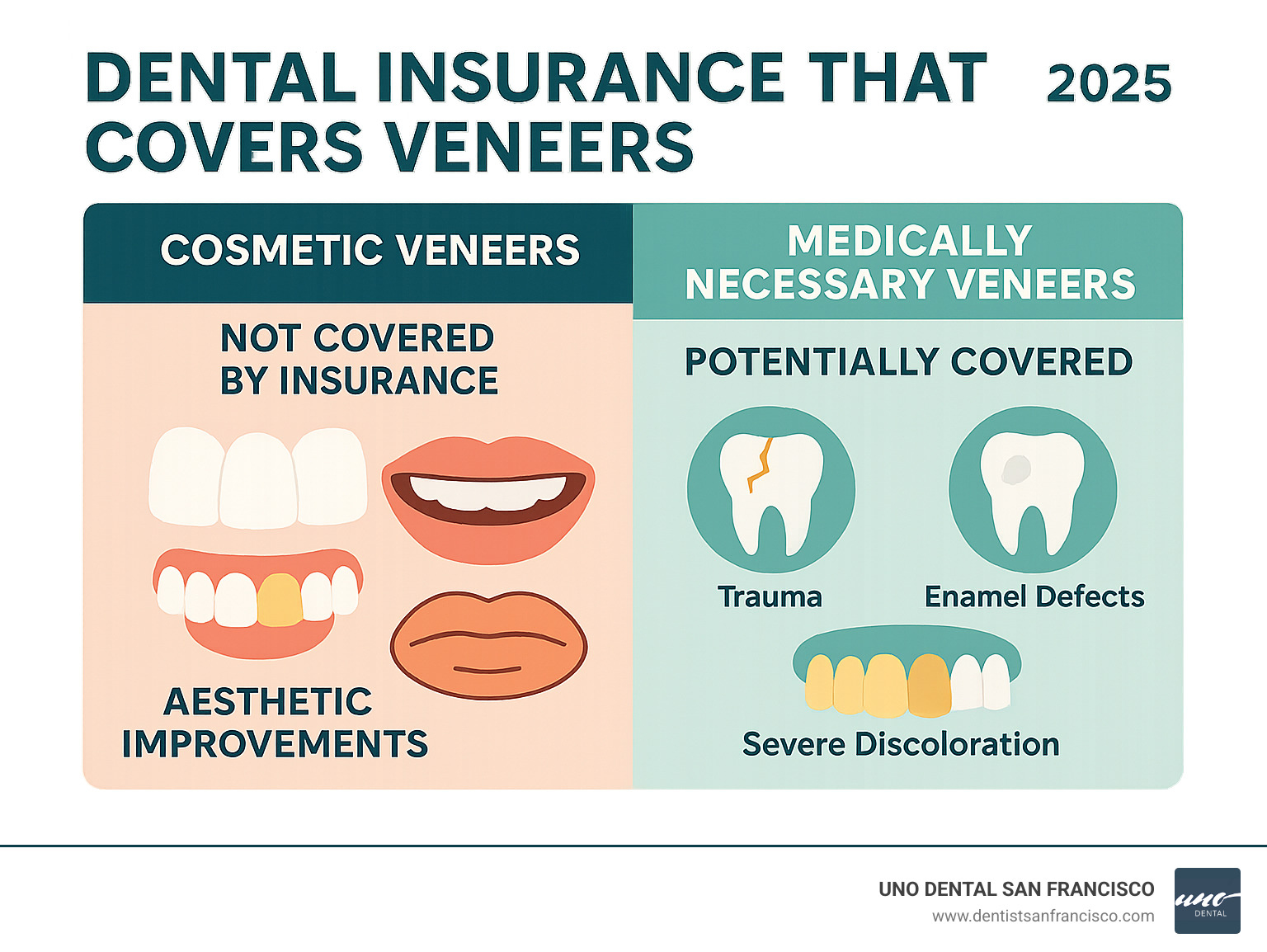

Quick Answer: Does dental insurance cover veneers?

- Generally no – excluded as cosmetic

- Possible – if the veneer restores function after trauma or corrects an enamel defect

- Typical payout – 0 % for cosmetic, up to 50 % for medically necessary cases

- PPO plans give you the best shot at partial coverage

- Pre-authorization and solid documentation are non-negotiable

Veneers cost about $900–$2,500 per tooth, and annual plan maximums hover around the same numbers. Even with help, insurance rarely makes a big dent.

The good news: when a veneer moves from “beauty upgrade” to medically necessary restoration, limited benefits may apply. As a restorative and cosmetic dentist with 15 + years of experience, I’ve guided many patients at UNO DENTAL SAN FRANCISCO through this exact gray area and helped them squeeze every dollar of coverage possible.

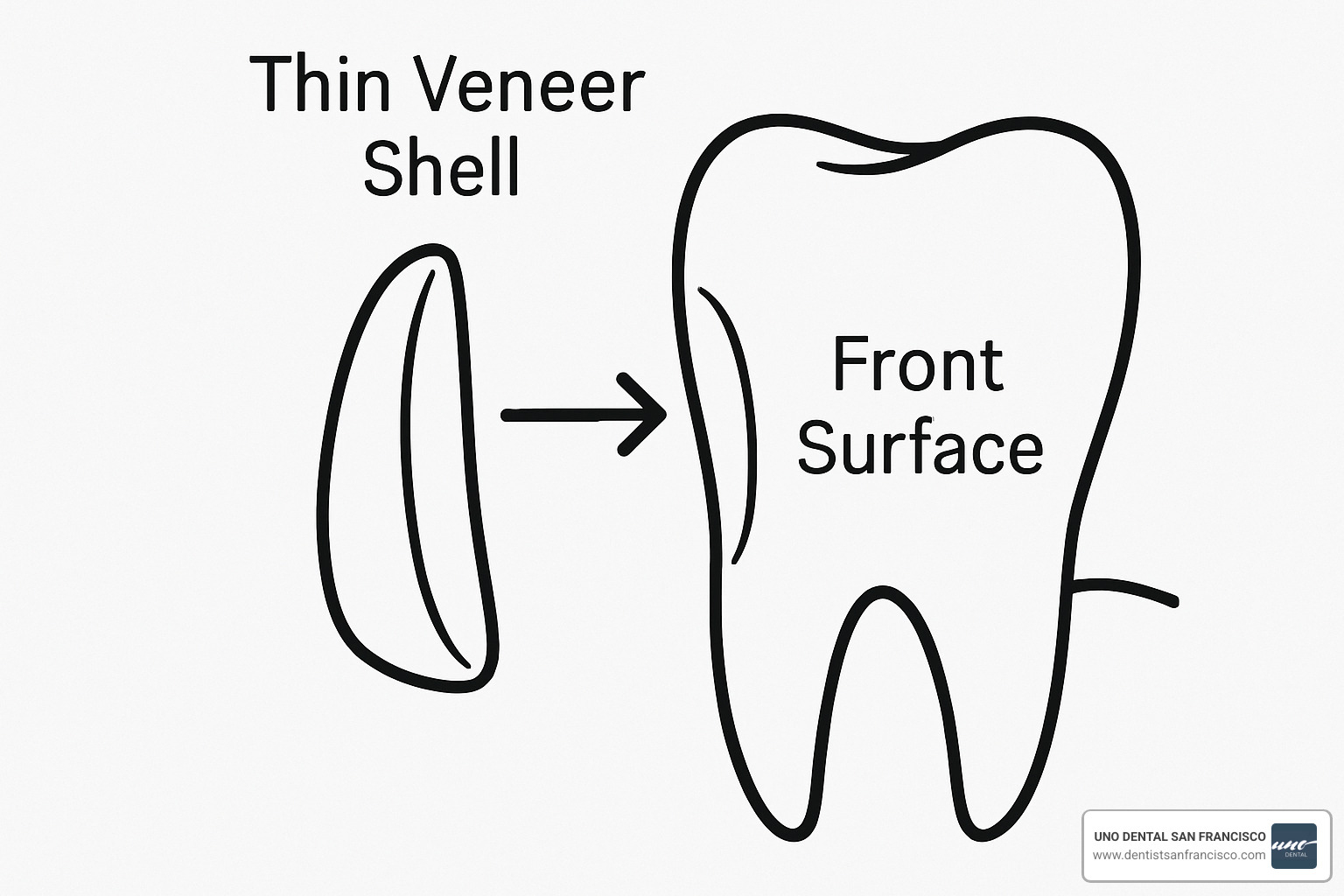

First, What Exactly Are Dental Veneers?

Think of veneers as thin, custom shells that mask chips, stains or gaps on the front of your teeth. A sliver of enamel (usually less than 1 mm) is removed, the veneer is bonded, and your smile is instantly upgraded.

The Main Types You’ll Hear About

- Porcelain veneers – gold-standard look and longevity (15–20 yrs), $900–$2,500 per tooth.

- Composite veneers – placed in one visit, easier to repair, 4–8 yr life, $400–$1,100 typical.

- Lumineers / no-prep veneers – ultra-thin, minimal enamel removal, $800–$2,000.

For insurance purposes, the material rarely matters; the reason you need it does.

Pros, Cons & Candidacy (Fast Version)

Pros: dramatic aesthetic change, stain-resistant, long-lasting.

Cons: irreversible enamel removal, future replacement costs, sensitivity risk.

Good candidates: healthy teeth and gums, enough enamel, realistic expectations.

Poor candidates: untreated decay, gum disease, severe bruxism.

At UNO DENTAL we verify health issues first—because no plan will pay for cosmetic veneers placed on unhealthy teeth.

The Million-Dollar Question: Does Dental Insurance Cover Veneers?

Most insurers treat veneers the same way health insurance treats a nose job: elective. Result? You pay 100 %.

When the Answer Can Flip to “Yes”

Coverage becomes possible when veneers restore health or function, for example:

- Tooth fractured in an accident

- Developmental enamel defects (hypoplasia, severe fluorosis)

- Replacing failing large restorations when a veneer is the least invasive fix

Insurers want proof. Your dentist must submit photos, X-rays and a narrative tying the veneer to function—not looks. UnitedHealthcare’s clinical policy is a good example of these criteria.

Plan Type Matters

- PPO – most lenient, partial out-of-network benefits.

- HMO – strict networks, pre-auth required.

- Discount plans – not insurance, but 20–60 % off the dentist’s fee can soften the blow.

Fine Print to Watch

Annual maximums ($1k–$2.5k), waiting periods, and “one veneer every X years” rules quickly limit payouts. Get the details in writing before treatment.

Your Action Plan: How to Verify Your Coverage

Here's the truth: most people find their coverage situation after they've already fallen in love with their potential new smile. Don't be that person sitting in the dental chair getting sticker shock. Taking a proactive approach now can save you from surprise bills and might even uncover coverage opportunities you didn't know existed.

Think of this as detective work. You're gathering evidence to build the strongest possible case for coverage, and even if you don't find any, you'll know exactly what you're dealing with financially.

Step 1: Review Your Policy Documents and Call Your Provider

Start with your Summary of Benefits document - yes, that boring paperwork you probably filed away and forgot about. You're looking for specific clues about dental insurance that covers veneers, including any cosmetic exclusions (most plans have them), major restorative category coverage percentages, and those pesky annual maximums and deductibles.

But here's the thing: don't rely solely on what's written down. Insurance documents can be confusing, and sometimes there are nuances that aren't clearly explained. Call your insurance company's customer service line directly and ask specifically about coverage for dental code D2962 (that's the official code for porcelain laminate veneers).

When you call, be sure to get a reference number for your inquiry. This creates a paper trail and can be helpful if there are any disputes later about what you were told.

Step 2: Request a Pre-Treatment Estimate

This step is absolutely crucial, yet many people skip it. A pre-authorization (also called pre-determination) is like getting a written promise from your insurance company about what they'll cover before you commit to treatment.

Here's how it works: your dentist submits the specific dental procedure codes along with clinical photos and documentation explaining why you need the treatment. If there's any chance your veneers could be considered medically necessary, this is where that case gets made.

The beauty of this process is that you get written confirmation of coverage before you're sitting in the treatment chair. No surprises, no arguments later - just clear expectations about what you'll pay out of pocket.

Step 3: Questions to Ask Your Dentist and Insurer

Come prepared with specific questions that get to the heart of your coverage situation. Don't be shy about asking - this is your money we're talking about.

For Your Dentist:

- "Can this be coded as medically necessary?" - This is the golden question that could open up coverage

- "What are the covered alternatives?" - Maybe bonding or crowns would be partially covered

- "What is my specific coverage for code D2962?" - Get the exact percentage and limitations

- "What are the exclusions for veneers?" - Know exactly what won't be covered

For Your Insurance Company:

Ask about your annual maximum and how much you've already used this year. If you're planning multiple veneers, timing might matter. Also, find out about any frequency limitations - some plans won't cover veneer replacements for several years after the initial placement.

The key is getting everything in writing. Verbal promises from insurance companies have a way of disappearing when it's time to pay claims.

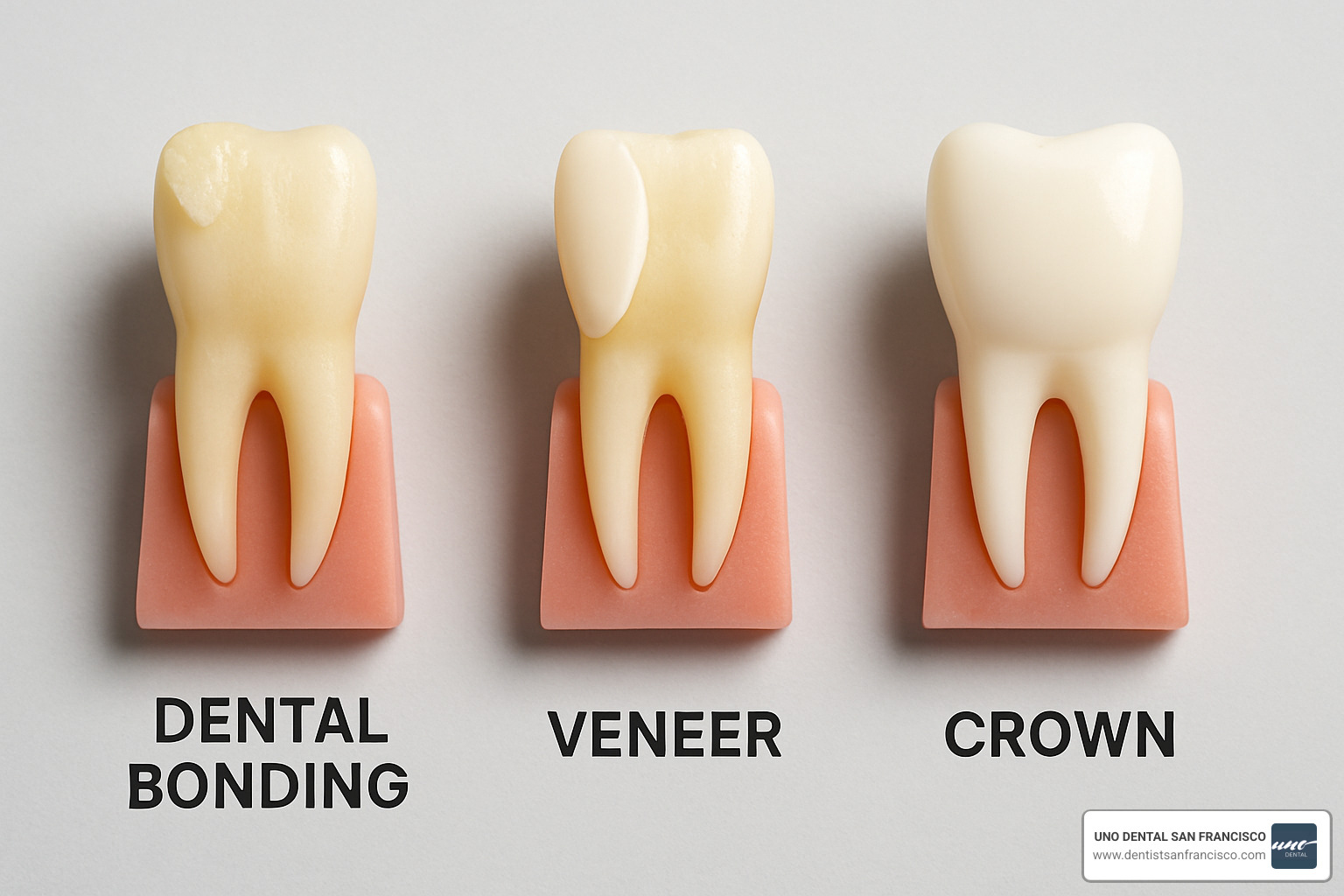

Veneer Alternatives and How They're Covered

If insurance won’t budge on veneers, consider treatments that insurers do like.

1. Dental Bonding

Fixes small chips or gaps with composite. One visit, $300–$600 a tooth, often 70 – 80 % covered as basic restorative care. Drawback: 3–10 yr lifespan and can stain.

2. Dental Crowns

Full-coverage cap for badly damaged teeth. Costs $800–$1,500; insurers usually pay 50 % under major restorative benefits. Lifespan 10–15 yrs.

3. Whitening or Orthodontics

Whitening gets zero coverage, but clear aligners or braces may be partly covered when correcting bite issues.

| Treatment | Typical Cost | Average Life | Usual Coverage |

|---|---|---|---|

| Veneer | $900–$2,500 | 10–20 yrs | 0–50 % (rare) |

| Bonding | $300–$600 | 3–10 yrs | 70–80 % |

| Crown | $800–$1,500 | 10–15 yrs | 50 % |

| Whitening | $300–$1,000 | 1–3 yrs | 0 % |

Often, starting with bonding or a crown gives 90 % of the cosmetic boost for a fraction of the out-of-pocket expense.

Paying for Veneers When Insurance Says No

When dental insurance that covers veneers isn't available, don't let that stop you from achieving your dream smile. The reality is that most people pay for veneers out of pocket, and there are several smart financial strategies to make treatment affordable without breaking the bank.

The key is planning ahead and exploring all your options. Many patients are surprised to learn that financing cosmetic dentistry can be more accessible than they initially thought.

In-Office Payment Plans and Third-Party Financing

Most dental practices understand that veneers are a significant investment, which is why many offer flexible payment solutions. At UNO DENTAL, we work with patients to create payment plans that fit their budget and timeline.

In-office payment plans are often the most straightforward option. These arrangements allow you to spread your treatment costs over several months, typically with little to no interest if you complete payments within a specific timeframe. The beauty of working directly with your dental office is the personal touch - they want to help you get the treatment you need.

Third-party financing opens up even more possibilities. Companies like CareCredit and LendingClub specialize in medical and dental financing, offering extended payment terms that can stretch from 12 to 84 months. These programs often feature promotional interest rates, sometimes as low as 0% for qualified applicants during introductory periods.

The approval process is typically quick and can often be completed right in the dental office. Many patients find that breaking down a $10,000 smile makeover into manageable monthly payments of $200-300 makes the treatment feel much more achievable.

What's particularly helpful is that these financing companies integrate seamlessly with dental practice systems, so you can get approved and start treatment on the same day.

Using Your Health Savings Account (HSA) or Flexible Spending Account (FSA)

Here's a financing strategy that many people overlook: using pre-tax dollars through your HSA or FSA. This approach effectively gives you a discount equal to your tax rate - if you're in a 25% tax bracket, you're saving 25% on your veneer treatment.

HSA advantages make this option particularly attractive. Your funds roll over year to year, so you can save up for treatment over time. There's no "use it or lose it" pressure, and you can even invest your HSA funds for growth while you're planning your treatment.

FSA considerations require more careful timing since these accounts typically operate on a "use it or lose it" basis within the plan year. However, if you're planning treatment within your current benefit year, an FSA can provide substantial savings.

The important thing to remember is that rules vary by employer and plan type. Some plans are more restrictive about cosmetic procedures, while others are more flexible. Check with your plan administrator before assuming coverage - you might be pleasantly surprised by what's allowed.

At UNO DENTAL, we're experienced in helping patients steer these payment options and can provide the documentation you need for reimbursement. Our team understands that achieving your ideal smile shouldn't require financial stress, and we're committed to finding solutions that work for your situation.

Frequently Asked Questions About Dental Insurance That Covers Veneers

How much do veneers cost without coverage?

- Porcelain: $900–$2,500 per tooth (15–20 yr life)

- Composite: $400–$1,100 per tooth (4–8 yr life)

- Lumineers: $800–$2,000 per tooth (similar to porcelain)

Fees rise in major metros like San Francisco and with highly trained cosmetic dentists.

Can I buy insurance just for cosmetic veneers?

Standard dental plans say no. A few carriers sell cosmetic “riders,” but they’re pricey and cap benefits at low amounts. Most patients instead use discount dental plans or financing.

If my veneer chips, will insurance pay for a replacement?

Only if the original veneer met medical-necessity rules and your plan’s frequency limits have passed (often 5–7 yrs). Cosmetic chips usually fall on you. Always ask your insurer about code D2962 replacement rules before the first veneer is placed.

Conclusion: Your Path to a Confident Smile

Let's be honest - finding dental insurance that covers veneers feels like searching for a unicorn sometimes. But here's the thing: it's not completely impossible, and even when insurance doesn't help, you still have options to get that smile you've been dreaming about.

The reality is that coverage is rare but possible, especially when your veneers serve a restorative purpose rather than just making you look like a movie star. Think tooth damage from an accident, severe enamel defects, or medication-related discoloration that affects your daily life. These situations can sometimes shift veneers from the "cosmetic" category into the "medically necessary" zone.

Pre-authorization is absolutely crucial - and I can't stress this enough. Getting written confirmation of coverage before you sit in the dental chair can save you thousands of dollars and major heartache. It's like getting a price quote before buying a car - you need to know what you're getting into.

Documentation matters more than you might think. Working with a dentist who understands insurance requirements and can provide proper clinical justification makes all the difference. At UNO DENTAL in San Francisco, we've helped countless patients steer this exact situation, and we know how to present your case in the best possible light.

Don't forget to consider alternatives like bonding and crowns. These treatments often have better coverage and might achieve results that are pretty darn close to what you're hoping for. Sometimes the "second choice" turns out to be perfect for your situation and your budget.

Explore financing options because here's the truth: lack of insurance coverage doesn't have to be a dead end. Between payment plans, third-party financing, and using your HSA or FSA funds, there are ways to make your dream smile financially manageable.

At UNO DENTAL, we get how frustrating it can be to steer dental insurance for cosmetic procedures. Our team combines clinical expertise with real-world insurance knowledge to help you achieve your smile goals while squeezing every possible benefit out of your coverage.

We offer free virtual smile consultations where we can take a look at your specific situation, talk through treatment options, and give you honest guidance about insurance coverage and financing alternatives. Our comprehensive approach means you'll have all the information you need to make a smart decision about your dental care.

Investing in your smile is really investing in your confidence and quality of life. While insurance coverage would be the cherry on top, don't let its absence stop you from exploring what's possible. With proper planning and the right dental team supporting you, your dream smile is probably more achievable than you think.

Your path to a confident smile might have a few twists and turns, but it's definitely worth the journey. Whether insurance helps out or you need to get creative with financing, the end result - that moment when you see your new smile for the first time - makes it all worthwhile.

Explore our comprehensive dental services and find how we can help you steer both the clinical and financial aspects of your smile change journey.