Your Dream Smile is More Attainable Than You Think

Pay for veneers monthly options have made beautiful smiles accessible to thousands who once thought them out of reach. With monthly payments as low as $99 and flexible financing, you can transform your smile without the stress of a large upfront payment.

Quick Monthly Payment Options for Veneers:

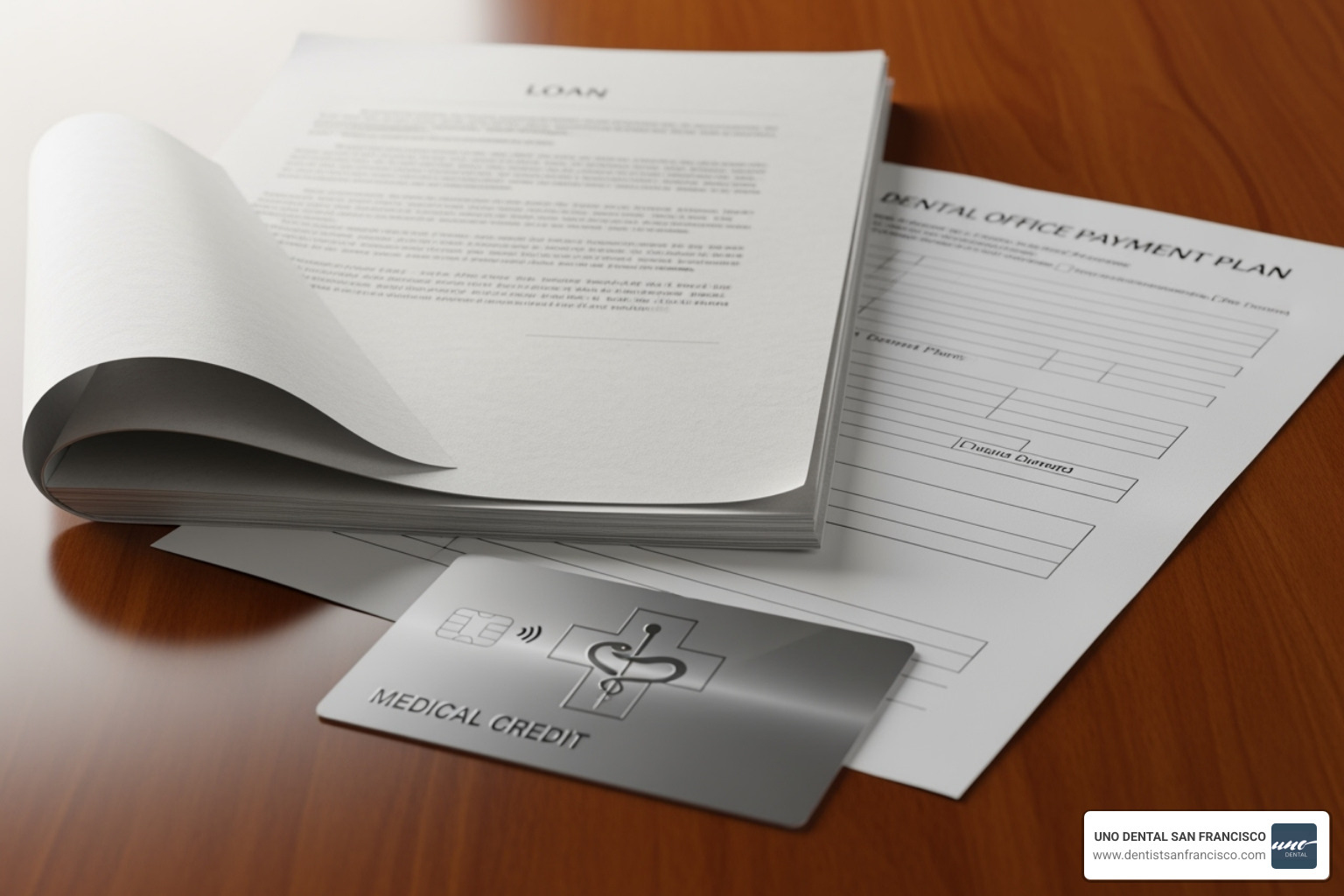

- In-house payment plans - Direct financing through your dental office

- Third-party medical financing - CareCredit, Cherry, LendingClub with 0% APR options

- Personal loans - Bank or credit union financing for dental work

- HSA/FSA accounts - Use pre-tax dollars for qualified dental expenses

- Medical credit cards - Specialized cards for healthcare expenses

The national average cost for veneers ranges from $500 to $2,895 per tooth, with a full set averaging $15,486. Breaking these costs into manageable monthly payments makes your dream smile surprisingly affordable. Many patients find that monthly payments of $200-400 fit comfortably into their budget.

As Mohammad Aghiad Kandar DDS at UNO DENTAL SAN FRANCISCO, I've helped hundreds of patients steer financing options to pay for veneers monthly, making smile changes accessible regardless of budget. My experience shows that the right payment plan can turn an impossible investment into a manageable monthly expense.

Understanding the Full Cost of Dental Veneers

When you're ready to pay for veneers monthly, understanding the full investment helps you budget and choose the right financing. Think of it like buying a car—you want to know the total price before shopping for the perfect monthly payment.

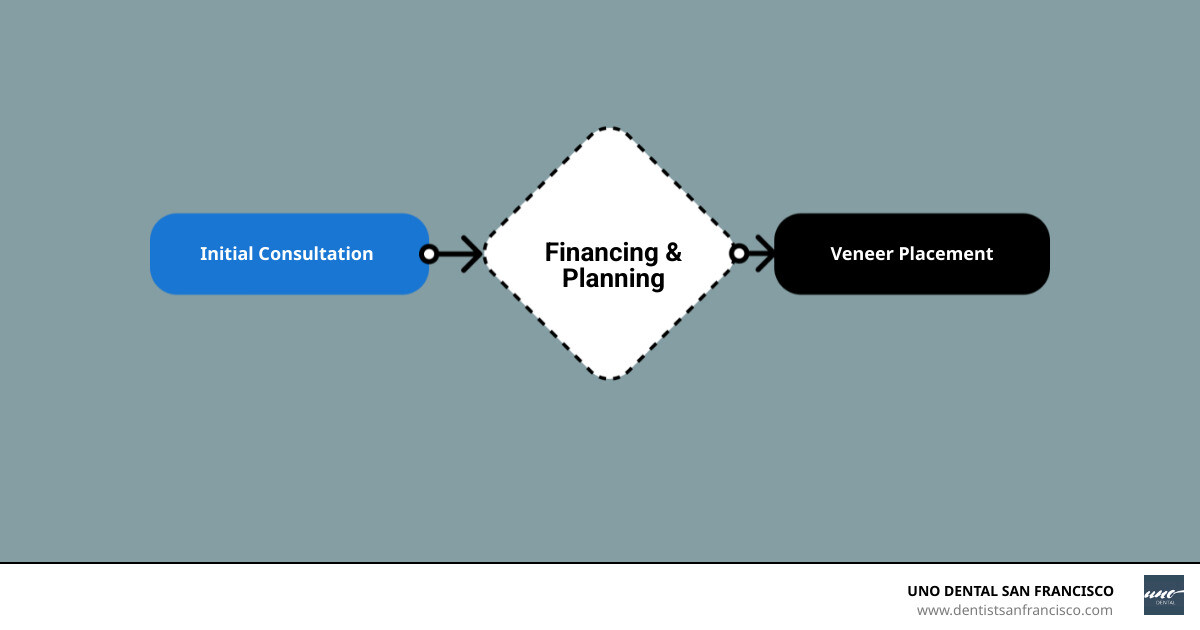

Dental veneers are custom-made, wafer-thin shells that cover the front surface of your teeth. They fix everything from stubborn stains and chips to gaps and slightly crooked teeth. The process takes a few appointments: consultation, tooth preparation (removing a tiny bit of enamel), taking impressions, fitting temporary veneers, and finally bonding your new permanent veneers.

Veneers are an investment in your confidence, career, and oral health. When you feel good about your smile, everything changes.

For more details about our complete approach to smile changes, check out more info about our cosmetic dentistry services.

Factors That Influence Veneer Pricing

Your veneer investment depends on several key factors that affect your total cost and monthly payments.

Veneer material makes the biggest difference in price. Porcelain veneers are the gold standard—they look incredibly natural, resist stains, and can last 15 to 20 years or more. They're crafted from high-quality ceramic that mimics real tooth enamel. Composite veneers cost less upfront but typically need replacement every 5 to 7 years. They're made from tooth-colored resin and can often be completed in a single visit.

Your dentist's expertise also impacts cost. Highly trained cosmetic dentists with years of experience typically charge more, but the results speak for themselves. At UNO DENTAL SAN FRANCISCO, our advanced training in aesthetic dentistry means you're investing in artistry, not just dentistry.

Geographic location plays a role too. San Francisco has higher overhead costs than smaller cities, which affects pricing. But you also get access to cutting-edge technology and world-class expertise.

The number of veneers you need directly affects your total investment. Some patients want just one or two veneers, while others choose a complete smile makeover with eight, ten, or more.

Additional procedures might be needed. We'll need X-rays and digital scans for precise planning. Any preliminary dental work like treating cavities or gum issues comes first—think of it as preparing the foundation before building your dream house. Sometimes temporary veneers are needed while your custom porcelain veneers are crafted.

Average Cost of Veneers in the U.S.

Let's talk real numbers so you can calculate your monthly payments. Porcelain veneers typically cost between $925 and $2,500 per tooth, with the national average around $1,765 per tooth. Composite veneers range from $250 to $1,500 per tooth—more budget-friendly upfront.

For a full set of veneers covering your smile (usually 6-8 teeth), expect an average cost of $15,486 nationally. Breaking this cost into monthly payments makes it much more manageable.

The lifespan comparison is important for your long-term budget. Porcelain veneers lasting 15-20 years means better value over time, despite the higher upfront cost. Composite veneers need replacement every 5-7 years, so factor that into your decision.

| Feature | Porcelain Veneers | Composite Veneers |

|---|---|---|

| Cost | $925-$2,500 per tooth (avg. $1,765) | $250-$1,500 per tooth |

| Lifespan | 15-20 years (can last up to 20 years or longer) | 5-7 years (typically 4-8 years) |

| Appearance | Highly natural, stain-resistant, superior aesthetics | Good, but more prone to staining, less translucent |

| Procedure Time | 2-3 visits over several weeks | Often 1 visit (chairside), sometimes 2 (lab-made) |

How to Pay for Veneers Monthly: Your Top Financing Options

Here's where your dream smile becomes achievable. There are many ways to pay for veneers monthly, changing a large cost into a manageable monthly expense.

Your smile is an important investment, just like a car or home. The key is finding a financing option that fits your budget and lifestyle.

In-House Dental Payment Plans

At UNO DENTAL SAN FRANCISCO, we believe financial barriers shouldn't prevent you from getting your perfect smile. We offer in-house payment plans custom to your situation.

These plans are a direct arrangement with our practice. You make a down payment and spread the balance over several months. We handle everything in-house, simplifying the process.

The convenience is a major benefit. You deal directly with our trusted team, avoiding lengthy applications and waiting for third-party approval.

Many patients love that credit requirements are often more flexible with in-house plans. While we ensure you can make payments comfortably, we're not as rigid as big financial companies. Your relationship with our practice matters more than just a credit score.

However, consider the trade-offs. In-house plans are typically shorter—usually 6 to 12 months—which means higher monthly payments. A down payment is also required, though we work with you to keep this reasonable.

Before committing, ask us about the down payment, monthly schedule, and any interest. Many of our plans are interest-free if you stick to the schedule. We'll also explain any late fees upfront—no surprises.

How to pay for veneers monthly with external lenders

If you need more time or different terms, third-party financing companies have revolutionized access to dental care.

Medical credit cards are a popular option. They're designed specifically for healthcare expenses. CareCredit leads the pack, and we're proud to accept it at UNO DENTAL SAN FRANCISCO. CareCredit offers promotional periods with 0% APR—sometimes for 6, 12, or even 18 months. Pay off your balance during that time, and you won't pay a penny in interest. You can find a provider that accepts CareCredit to see how widely it's accepted.

Personal loans offer another solid path to pay for veneers monthly. Companies like LendingClub specialize in personal loans for dental treatments, typically with fixed interest rates and predictable monthly payments.

Cherry deserves special mention. They do a soft credit check initially (which won't ding your credit score) and are flexible with approval. They also report your on-time payments to all three credit bureaus, which helps build your credit history. They advertise monthly payments starting around $149 down, with some weekly payment options as low as $24-$33.

The biggest advantage of external lenders is time—you can often stretch payments over 24 to 60 months, making your monthly commitment very manageable. Those promotional 0% APR periods can save you serious money.

The downside? Credit approval is required, and if you miss promotional periods or have challenging credit, interest rates can climb quickly. Always read the fine print.

Using Personal Savings, Credit Cards, and HSAs/FSAs

Other smart funding options exist. Personal savings is an obvious choice, eliminating all interest and fees for immediate peace of mind.

Existing credit cards can work for smaller cases, especially if you have a low interest rate or can pay off the balance quickly. The simplicity is appealing, but standard credit card rates are typically high.

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) are a great option. These let you pay for qualified medical expenses with pre-tax dollars, which is like getting an automatic discount. If you're in a 25% tax bracket, you're essentially saving 25% on your veneers.

Most HSA and FSA accounts have debit cards, or you can pay and submit receipts for reimbursement. Veneers typically qualify if there's a medical or functional component to the treatment.

The bottom line is there's likely a way to pay for veneers monthly that fits your situation. The key is choosing the option that offers the most comfort and flexibility.

Additional Strategies to Make Veneers More Affordable

If traditional veneers feel financially out of reach, don't despair. Several smart strategies and alternatives exist.

Does Dental Insurance Cover Veneers?

This is a common question. The answer is usually "no," as most insurance plans classify veneers as a cosmetic procedure and don't cover them. However, there are nuances:

- Cosmetic vs. Medically Necessary: If veneers are purely for aesthetic improvement, insurance typically won't cover them.

- When Insurance Might Provide Coverage: In specific situations, veneers might be deemed medically necessary and at least partially covered:

- Trauma: If a tooth is chipped or broken in an accident, a veneer to restore its function might be partially covered.

- Decay or Structural Damage: If a veneer restores a tooth with significant decay or damage, it might be considered restorative.

- Replacing Old Restorations: If an existing, functional restoration needs replacement, parts of the cost might be covered.

- How to Check Your Policy: Always contact your insurance provider directly. Ask about coverage for "cosmetic dental procedures" and specifically for "veneers."

- Importance of Pre-Authorization: If you believe your case might qualify, request a pre-authorization from your insurance company before starting treatment to clarify coverage.

For more detailed information on dental coverage for veneers, you can refer to resources like Learn more about dental coverage for veneers.

Exploring Lower-Cost Options Within Professional Dental Care

Other professional dental treatments can also improve your smile at a lower cost:

- Dental Bonding as a Cost-Effective Alternative: Dental bonding uses composite resin, the same material as composite veneers. It's an excellent, affordable option for minor issues like small chips, cracks, or gaps.

- How it works: The resin is applied to the tooth, sculpted, hardened with a special light, and polished.

- Benefits: It's typically a single-visit procedure, less expensive (around $300-$600 per tooth), and reversible since it usually doesn't require removing tooth enamel.

- When it may be appropriate: Bonding is ideal for minor corrections. However, it's not as durable or stain-resistant as porcelain and usually lasts 3 to 10 years.

- Dental Discount Plans: These are membership programs where you pay an annual fee for reduced rates on dental treatments, including cosmetic procedures like veneers.

- Dental Schools: For those on a very tight budget, dental schools are a great option. Procedures are performed by supervised students at significantly lower costs, though appointments are often longer.

At UNO DENTAL SAN FRANCISCO, we offer personalized consultations to discuss all suitable options for your smile and budget, helping you find the best path forward.

What are Snap-On Veneers? A Budget-Friendly Alternative

When exploring how to pay for veneers monthly, snap-on veneers often appear as a budget option. They differ from traditional dental veneers, so it's important to understand what they can and can't do.

Snap-on veneers (or clip-on veneers) are thin, custom appliances that fit over your teeth like a mouthguard. They are a temporary cosmetic cover-up, not a permanent dental treatment.

The appeal is affordability. While a single porcelain veneer might cost $1,765, a full set of snap-on veneers typically ranges from $370 to $570. Some companies offer payment plans, such as $295 down and three monthly payments of $99.

Here's how they work: Most snap-on veneer companies operate online. They send you an at-home impression kit, you take your own impressions and mail them back, and you receive your custom veneers in a few weeks. No drilling, injections, or dental visits are required.

The process sounds simple, but there are significant trade-offs. Snap-on veneers often look bulkier and less natural because they add a layer over your teeth, which can make your smile appear artificial. Many users report difficulty with speech and eating.

More importantly, snap-on veneers don't address underlying dental health issues. If you have decay or gum disease, these appliances simply cover them up. They require diligent cleaning to prevent bacterial buildup and are less durable than traditional veneers.

At UNO DENTAL SAN FRANCISCO, I see patients who tried snap-on veneers first and later invested in traditional ones for a more natural, lasting result. While snap-on veneers can provide a quick cosmetic boost for special events, they aren't a substitute for professional dental treatment.

If cost is your primary concern, exploring financing to pay for veneers monthly through professional dental care often provides better long-term value. During our free virtual consultations, we can discuss all your options, from snap-on alternatives to financing plans that make traditional veneers affordable.

The choice depends on your goals, timeline, and budget. Snap-on veneers can be a temporary solution, but for a permanent, natural-looking smile, traditional veneers with monthly payments remain the gold standard.

Frequently Asked Questions About Veneer Payments

I get these questions daily from patients worried about the financial side of veneers. Here are the answers that have helped hundreds pay for veneers monthly and achieve their dream smiles.

Can you finance veneers with bad credit?

Yes. A lower credit score makes things trickier, but it doesn't close the door on your smile dreams. I've helped many patients who thought their credit was a dealbreaker find solutions.

In-house payment plans are often your best bet. Many dental offices, including ours at UNO DENTAL SAN FRANCISCO, focus more on your ability to make payments than past credit issues. We might ask for a larger down payment but are generally more flexible than big financial institutions.

Specialized lenders like Cherry work with people who have less-than-perfect credit. They do a "soft" credit check initially (which won't hurt your score). Cherry also reports your on-time payments to credit bureaus, so you're building better credit while getting your new smile.

Secured personal loans are another path. If you have an asset as collateral, you can often get better rates even with poor credit.

The reality is you'll likely face higher interest rates with bad credit, so read the terms carefully. But don't let past financial struggles prevent you from gaining the confidence of a beautiful smile.

What is the typical monthly payment for a full set of veneers?

This varies based on your treatment and financing terms, but here are some real numbers.

For a full set of veneers averaging $15,486, here's what monthly payments might look like: Financing $15,000 over 60 months at 8% interest is approximately $304 per month. That's less than many car payments!

For smaller cases—perhaps two to four veneers, or choosing composite over porcelain—monthly payments can start as low as $99. I've seen patients transform their smiles with just a few strategically placed veneers, keeping costs manageable.

The key factors are the total cost, your down payment, the loan length, and the interest rate. During your consultation, we can run the exact numbers for your situation so there are no surprises.

Is it a good idea to pay for veneers monthly?

This is a personal decision that depends on how you view investing in yourself. Here's what I've observed from helping patients make this choice.

Monthly payments make treatment immediately accessible instead of waiting years to save up. I've seen patients' entire demeanor change the moment they see their new smile. The confidence boost often pays dividends in personal and professional relationships.

From a budgeting perspective, breaking down a large expense into predictable monthly payments makes financial planning easier. Most patients find $200-400 monthly fits comfortably into their budget.

The potential downsides are real. Unless you get a 0% APR deal and pay it off in time, you'll pay interest, increasing your total cost. You're also committing to debt for several years.

My take: if a beautiful smile will genuinely improve your quality of life, confidence, and opportunities, the interest cost is often worth it. It's an investment in yourself that benefits you daily for decades.

The best option depends on your financial situation and priorities. We can explore all your options during a consultation to find a payment plan that feels comfortable and sustainable.

Your Next Steps to a Brighter Smile

The journey to your dream smile doesn't have to be overwhelming. We've explored many ways you can pay for veneers monthly, turning a large expense into manageable payments that fit your budget.

Whether you choose an in-house payment plan, explore third-party financing like CareCredit or Cherry, or use your HSA funds, there is a financial path for almost every situation. The key is finding the right option that gives you peace of mind.

Your perfect smile is an investment in yourself—your confidence, your joy, and how you present yourself to the world. Patients at UNO DENTAL SAN FRANCISCO consistently tell me their new smile changed how they feel about themselves daily.

The most important step is scheduling a personalized consultation. Every smile and financial situation is unique. Our free virtual smile consultations allow us to assess your needs, discuss veneer options, and create a custom treatment plan.

During your consultation, we'll provide a detailed cost breakdown and walk through all available financing options. This way, you'll understand exactly how to pay for veneers monthly in a way that feels comfortable and sustainable. There's no pressure—just an honest conversation about what's possible.

Ready to take the first step? Contact us today to schedule your free virtual smile consultation. While exploring your options, I also encourage you to check out our GleamBar Membership for savings on dental care, which offers additional discounts on various dental services.

Your dream smile is closer than you think. With the right financing plan and our team's expertise, we can help you smile brighter, sooner than you ever imagined.