Why Dental Crown Financing Options Make Quality Care Accessible

Dental crown financing options make essential oral healthcare accessible by changing a significant expense into manageable monthly payments. Multiple solutions exist to fit different budgets and credit situations, ensuring you can get the care you need most.

Quick Overview of Your Main Financing Choices:

- Specialized Healthcare Lenders - Often offer 0% promotional periods with high approval rates

- Personal Loans - Fixed rates and terms from banks, credit unions, or online lenders

- In-House Payment Plans - Direct arrangements with your dental office

- HSA/FSA Accounts - Use pre-tax dollars for immediate savings

The national average cost for dental crowns ranges from $697 to $1,399, according to recent industry data. With financing, you can spread these costs over time while getting the care you need today.

Many patients find that financing approval is easier than expected. Some lenders report very high approval rates for patients who apply through participating dental offices—significantly higher than traditional lending.

As Dr. Mohammad Aghiad Kandar at UNO DENTAL SAN FRANCISCO, I have over 15 years of experience helping patients steer dental crown financing options. My team and I work with various financing partners to ensure cost is never a barrier to your oral health, creating payment solutions that fit each patient's unique situation.

Dental crown financing options basics:

Medically reviewed by Dr. Mohammad Aghiad Kandar, UNO DENTAL SAN FRANCISCO.

Understanding the Cost of a Dental Crown

Understanding the cost of a dental crown is the first step in choosing the right dental crown financing options. A crown is a custom-made cap that covers a damaged tooth to restore its strength, function, and appearance.

The cost of dental crowns typically ranges from $697 to $1,399 nationwide. Geographic location plays a significant role; you can check typical costs in your area to get a better sense of local pricing.

At UNO DENTAL SAN FRANCISCO, we provide transparent pricing from your first consultation. Whether you're considering traditional Dental Crowns San Francisco or our convenient Same Day Crowns San Francisco service, we'll give you a detailed cost breakdown as part of our comprehensive Restorative Dentistry approach.

What Factors Influence the Price?

Several key elements determine your crown's final cost, and understanding them helps you see why dental crown financing options are so valuable.

Crown material makes the biggest difference. Porcelain crowns offer the most natural look, ideal for front teeth. Zirconia crowns provide exceptional strength and a tooth-colored appearance, making them versatile for any tooth. Porcelain-fused-to-metal options combine durability with good aesthetics, though a metal line may appear at the gumline over time. Metal alloy crowns (including gold) are the most durable and work well for back molars where strength is paramount.

Technology used also impacts cost and convenience. Traditional crowns require multiple visits. Our CEREC same-day technology allows us to design, create, and place your permanent crown in a single visit. This eliminates uncomfortable impressions, temporary crowns, and multiple appointments. Many patients find the convenience is a worthwhile investment.

Tooth location affects pricing. Front teeth require more detailed aesthetic work, while back molars need extra strength for chewing.

Additional procedures like a root canal or core buildup can add to the total cost. During your consultation, we'll identify any preparatory work needed and explain how it fits into your overall treatment plan.

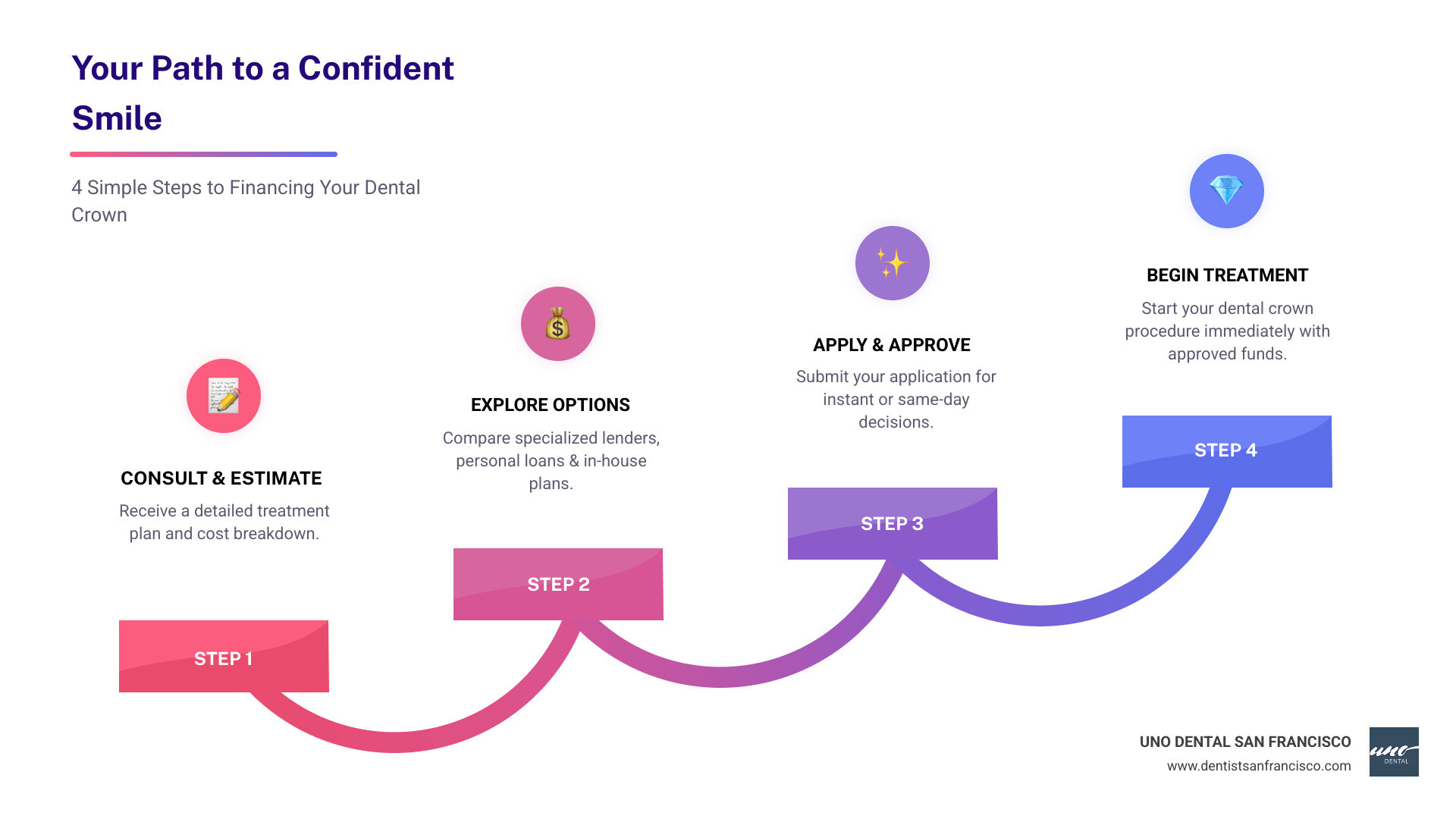

Exploring Your Dental Crown Financing Options

Now that you understand the costs, let's explore how to make your dental crown affordable. Dental crown financing options are more accessible than ever, and the right solution can turn an overwhelming expense into manageable monthly payments. With options ranging from 0% promotional periods to high approval rates, quality treatment is within reach.

At UNO DENTAL SAN FRANCISCO, we help patients find financing that bridges the gap between needing and affording our comprehensive Restorative Dentistry services.

Specialized Healthcare Lenders

These companies specialize in medical and dental expenses, offering patient-friendly terms and high approval rates. They understand that healthcare is a necessity, not a luxury. Many offer features such as:

- Promotional 0% APR periods (often 6-24 months for qualifying purchases). It's important to understand if these offers use "deferred interest." With this model, interest is calculated from day one and is only waived if you pay the full balance by the promotional deadline. If you miss the deadline, you will be charged all the accumulated interest retroactively.

- High approval rates, with some lenders approving a large majority of applicants.

- Quick application processes, often with instant decisions.

- Soft credit checks for initial applications, which do not impact your credit score.

- Flexible terms that can extend up to several years, with APRs varying based on the plan and your credit.

Personal Loans for Dental Work

Unsecured personal loans from banks, credit unions, or online lenders offer another way to finance your care. You receive a lump sum to pay for your treatment.

The main benefit of a personal loan is predictability. You get a fixed interest rate, a set repayment term, and a consistent monthly payment. This provides certainty and separates your dental financing from other healthcare credit lines.

Interest rates typically range from 7% to 36%, depending on your credit score and income. Those with excellent credit may secure lower rates than standard healthcare financing APRs. Most lenders, especially online ones, provide same-day decisions and fast funding.

In-House Plans and Other Solutions

Sometimes the simplest arrangement is working directly with our office. Dental office payment plans are often interest-free and allow you to spread payments over several months. We can discuss if this is a viable option for your treatment during your consultation.

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) are smart ways to pay for dental crowns. These accounts let you use pre-tax dollars, effectively giving you a discount equal to your tax bracket. While HSAs roll over, FSAs are typically "use it or lose it," so timing is key. Many patients combine HSA/FSA funds with financing to cover the full cost, making Affordable Dental Care San Francisco a reality.

Comparing Your Top Financing Choices

| Feature | Specialized Lenders | Personal Loans | In-House Plans/HSA/FSA |

|---|---|---|---|

| Interest Rate | Often 0% promo periods; Standard APR can be high | Fixed APR (6%-36%); Varies by credit | Typically interest-free; HSA/FSA are your own funds |

| Best For | Spreading costs with potential 0% interest | Large treatment plans; Consolidating costs | Smaller balances; Using pre-tax savings |

| Approval | High approval rates; Some options for lower credit | Based on credit score & income | No approval needed for HSA/FSA; Varies for plans |

| Flexibility | Revolving credit line for future care | One-time lump sum | Varies by office; Governed by IRS rules |

How to Choose the Right Financing Plan for You

Choosing the right dental crown financing options doesn't have to be overwhelming. The best plan is the one that fits your financial picture and lets you proceed with treatment without stress. Your ideal solution depends on your budget, the extent of your dental work, and your credit situation. At UNO DENTAL SAN FRANCISCO, we help patients steer these choices every day.

Key Factors to Compare in Dental Crown Financing Options

When comparing plans, it's important to look beyond just the monthly payment.

The interest rate (APR) is the yearly cost of borrowing. A lower APR saves you money. Promotional 0% APR offers can be great deals if you can pay off the balance before they expire. Financial experts generally consider an APR above 36% to be unaffordable.

Repayment term length involves a trade-off. Longer terms mean smaller monthly payments but more total interest paid. Shorter terms have higher payments but cost less overall.

Your monthly payment amount must fit comfortably within your budget without causing financial strain.

Watch for origination fees on personal loans (1%-10% of the loan amount) and prepayment penalties if you plan to pay the loan off early. The best loans have no such penalties.

Finally, fully understand deferred interest clauses. With these promotions, if you don't pay the full balance on time, you'll owe all the interest that has accrued since day one.

The Role of Your Credit Score in Dental Crown Financing Options

Your credit score significantly influences which dental crown financing options are available. Higher scores (typically on a 300-850 scale) generally lead to better interest rates and terms.

A FICO score above 680-700 is considered good and will likely qualify you for favorable terms. However, scores below that don't rule out financing. Many specialized healthcare lenders have high approval rates, making financing accessible even for those with fair or poor credit.

For those with lower scores, a co-signer with good credit can be a great solution. A co-signer shares responsibility for the loan, reducing the lender's risk and often securing you better terms.

Before applying, we recommend checking your credit report for free to check for errors. If you have time before your procedure, you can work on improving your creditworthiness by paying bills on time and reducing existing debt. Even small improvements can help.

The Role of Dental Insurance

Your dental insurance is a powerful tool for making your crown more affordable. Think of it as your first line of financial defense, with dental crown financing options serving as the backup to cover what insurance doesn't.

Most dental plans classify crowns as major restorative care, typically covering 50% to 80% of the cost. However, your actual coverage depends on your plan's deductible, co-pay, and annual maximum. The annual maximum is the total amount your insurance will pay in a year; once you reach it, you are responsible for 100% of further costs.

Dental insurance rarely covers the entire cost of a crown. The gap between what insurance pays and the total cost is where dental crown financing options become essential.

At UNO DENTAL SAN FRANCISCO, we work with many insurance providers. We'll help you maximize your benefits and understand your out-of-pocket costs. Learn more on our Dental Insurance and Financing page.

How Insurance and Financing Work Together

The most effective strategy combines insurance with financing. First, we submit a claim to your insurance, which covers its designated portion of the cost. Then, you can use your chosen financing plan to cover the remaining balance, converting a large out-of-pocket expense into manageable monthly payments.

This approach reduces the total amount you need to finance, saving you money on interest over time. Our team helps you time your treatment strategically to get the most from your insurance benefits, making the entire process as smooth as possible.

Frequently Asked Questions about Dental Crown Financing

We know that exploring dental crown financing options can be confusing. Here are answers to the questions we hear most often at UNO DENTAL SAN FRANCISCO.

Can I get financing for a dental crown with a low credit score?

Yes, financing can be accessible even with a low credit score. Many specialized healthcare lenders focus on high approval rates and use soft credit checks that don't impact your score. Some lenders approve a high percentage of applicants, making care available to more people. Adding a co-signer with good credit can also significantly improve your approval chances and interest rate. Don't assume you won't qualify; let us help you explore the options.

What's the difference between 0% APR and "deferred interest"?

This is a critical distinction. True 0% APR means no interest is charged during the promotional period. If a balance remains after the period ends, interest only applies to that remaining amount going forward. Deferred interest means interest is calculated from day one. It is waived only if the entire balance is paid before the promotion ends. If not, all the back-interest is added to your account. Always read the fine print to understand which type of offer you're getting.

How quickly can I get approved and start my crown procedure?

The speed of modern dental financing is impressive. Most specialized healthcare lenders provide instant or same-day decisions. You can often complete an application on your phone in our office and know your status in minutes.

This speed is a perfect match for our Same Day Crowns San Francisco technology. It's possible to have your consultation, get financing approval, and receive your permanent crown in a single, efficient visit. Once your financing is in place, we can schedule your treatment immediately, removing any delays in getting the care you need.

Get the Smile You Deserve Without the Financial Stress

A dental crown is a vital investment in your oral health and confidence. While the cost can seem daunting, numerous dental crown financing options make this essential care accessible and manageable for nearly any budget.

The beauty of today's financing landscape is its flexibility. Whether you choose a promotional 0% APR period from a specialized lender, a predictable personal loan, or use your HSA/FSA funds, a solution exists that can work for you.

Understanding how these options align with your insurance, credit, and budget is key. That's where our team at UNO DENTAL SAN FRANCISCO excels. We don't just provide exceptional dental care; we take the time to help you steer these financial decisions with confidence.

In my 15+ years of practice, I've seen countless patients find relief after finding that financing made their treatment surprisingly affordable. Helping you restore your oral health without financial strain is why we are so committed to providing clear financing guidance alongside our high-tech, holistic dental services.

Delaying a necessary crown can lead to more complex and expensive problems. By acting now with a financing plan that fits your budget, you are making a smart investment in your long-term health.

Ready to explore how we can make your crown treatment work within your budget? Explore our dental plans for cosmetic and restorative care and find how accessible quality dental care can be.