Understanding Your Options: Why Dental Coverage Doesn't Have to Be One-Size-Fits-All

Medically reviewed by: Mohammad Aghiad Kandar, DDS, UNO Dental San Francisco. Review date: November 28, 2025.

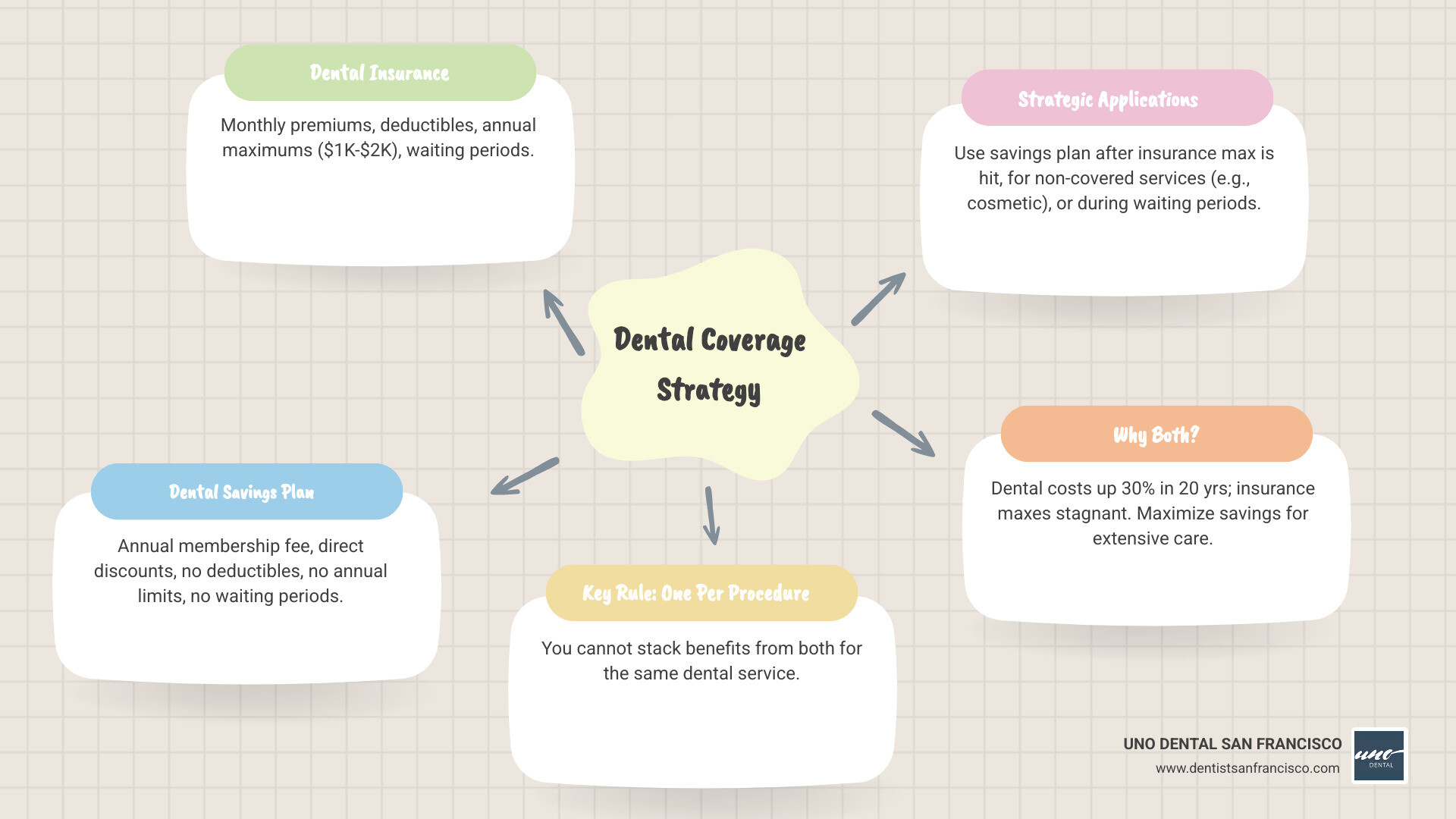

Can you use a dental savings plan with dental insurance? Yes, you can have both, but here's what you need to know:

- You cannot use both for the same procedure - You must choose one plan per service

- You can use them strategically for different procedures - Apply insurance to one service and your savings plan to another

- Use your savings plan after hitting insurance limits - Get discounts on care once you've reached your annual maximum (typically $1,000-$2,000)

- Cover services insurance won't pay for - Use savings plan discounts on cosmetic procedures or treatments with waiting periods

- Best for extensive dental needs - Especially valuable if you need multiple major procedures or orthodontics

Dental care costs in the U.S. have grown by 30% over the last 20 years, yet dental insurance annual maximums have remained largely unchanged at $1,000-$2,000 per year. This growing gap leaves many patients wondering how to afford necessary care.

You might have insurance through your employer or have heard about dental savings plans as an alternative. But what if you could use both to maximize your coverage and minimize your out-of-pocket costs?

As Mohammad Aghiad Kandar, DDS, with over 15 years of experience helping San Francisco patients steer their dental benefits, I've guided countless individuals on can you use a dental savings plan with dental insurance to create customized financial strategies. The key is understanding when and how to leverage each option.

Dental Insurance vs. Dental Savings Plans: A Head-to-Head Comparison

To effectively use a dental savings plan and insurance together, you must understand their differences. While both help you save, they operate in completely different ways.

Think of dental insurance like car insurance: you pay premiums for partial reimbursement up to a set limit. A dental savings plan is more like a club membership for your teeth: you pay an annual fee for instant access to discounted prices. This section breaks down the fundamental differences so you know what you're paying for and the benefits you receive.

| Feature | Dental Insurance | Dental Savings Plan (Discount Plan) |

|---|---|---|

| Monthly Cost | Monthly premiums (e.g., $20-$50/individual) | Annual membership fee (e.g., $100-$150/individual), no monthly fees |

| How It Works | Pays a percentage of covered services after deductibles and copays, up to an annual maximum. | Provides discounted rates at participating dentists; you pay the discounted amount directly. |

| Deductibles | Often required (e.g., $50-$100) before benefits kick in. | No deductibles. |

| Annual Limits | Typically $1,000-$2,000 per year. Once reached, you pay 100% out-of-pocket. | No annual limits or maximums on discounts. |

| Waiting Periods | Common for basic (e.g., 3-6 months) and major (e.g., 6-12 months) procedures. | No waiting periods; discounts are usually available immediately. |

| Procedure Coverage | Categorizes services (preventive, basic, major) and covers percentages (e.g., 100% preventive, 50-80% basic, 20-50% major). May exclude cosmetic. | Offers a percentage discount (e.g., 15-50%) on most procedures, including cosmetic and specialized treatments. |

| Claims | Dentist files claims with the insurance company. | No claims to file; you pay the discounted rate at the time of service. |

How Dental Insurance Works

Dental insurance is a contract where you or your employer pay a monthly premium for coverage. Most plans involve several parts. Your premiums are regular monthly payments ($20-$50/individual) to keep coverage active.

First, you'll likely need to meet your deductible – the amount you pay out-of-pocket before insurance kicks in, usually $50-$100 per year. After that, your insurance helps with costs, but you're still responsible for a portion.

For most procedures, you'll have a copayment (a flat fee) or coinsurance (a percentage of the cost). For example, your plan might cover 80% of a filling, leaving you to pay 20%. Coverage percentages depend on the procedure category: preventive care is often 100% covered, basic procedures 70-80%, and major work only 50%.

The biggest limitation is the annual maximum. Most plans cap their contribution at $1,000 to $2,000 per year. Once you hit that ceiling, you pay 100% of additional costs. This is where knowing can you use a dental savings plan with dental insurance becomes incredibly valuable.

Another frustration is waiting periods. New insurance plans may require you to wait three to twelve months before using benefits for basic or major procedures.

Insurance plans also have in-network and out-of-network providers. In-network dentists have agreed to accept negotiated rates, meaning lower costs for you. Going out-of-network often means you'll pay more.

At UNO Dental San Francisco, we are in-network preferred providers for several major PPO plans. We also accept many other PPO plans as out-of-network providers. Our team is experienced at helping patients maximize their coverage. For more details, visit our Dental Insurance & Financing Options page.

How Dental Savings Plans Work

Dental savings plans are different. They aren't insurance but membership programs providing access to discounted dental services.

The structure is simple. You pay an annual membership fee – typically $100 to $150 for an individual. Once a member, you get immediate direct discounts on procedures, usually 15% to 50% off.

The beauty of savings plans is what they don't have. There are no waiting periods, so you can sign up today and use your discount tomorrow. There are also no annual limits, so you can keep receiving discounts no matter how much work you need.

You won't deal with deductibles or copayments. The math is straightforward: you see the discounted price and pay that amount at the time of service. There are no claim forms to file and no surprise bills.

The only requirement is visiting a participating dentist. At UNO Dental San Francisco, we offer our own Dental Membership Plan as an affordable, transparent alternative to traditional insurance.

Dental savings plans work well for people without insurance, for procedures insurance doesn't cover (like cosmetic work), or as a complement to existing insurance when you've maxed out your benefits. To learn more, check out our page on Making Dental Care Affordable: Alternatives to Dental Insurance.

So, Can You Use a Dental Savings Plan with Dental Insurance?

We often hear from our patients at UNO Dental San Francisco, can you use a dental savings plan with dental insurance? The answer is yes, you can have both. The key to maximizing savings is knowing how and when to use each one to your advantage. It’s not about using them together for one service, but strategically leveraging their unique strengths in different situations.

The "One or the Other" Rule for Procedures

When you're at the dentist for a specific procedure, you generally can't "stack" your dental insurance and your dental savings plan. For a single service, you'll need to choose just one plan per procedure.

This is because of how each plan is structured. Dental insurance pays a portion of the cost, while a savings plan gives you a direct discount off the dentist's usual fee. You can't apply a discount to a fee that's already being partially covered by an insurance payment.

This is also why dental savings plans aren't insurance. You may have heard of Coordination of Benefits (COB) rules, which apply when someone has two different dental insurance plans. These rules decide which insurance pays first. However, since a savings plan is a membership program, it doesn't fall under COB rules. The American Dental Association offers Guidance on Coordination of Benefits for multiple insurance policies, but this doesn't apply to savings plans.

While you can't double-dip on a single service, the real genius is using each plan for different aspects of your overall dental care.

Strategic Scenarios: How to Use Both to Your Advantage

The true power of having both a dental savings plan and insurance shines when you use them strategically. They complement each other, helping you save money and access care. Here are smart ways our patients at UNO Dental use both:

-

After Hitting Your Insurance Annual Maximum: This is the most common and effective strategy. Most dental insurance plans have an annual maximum of $1,000 to $2,000. Once your insurance stops paying, you're responsible for 100% of further costs. This is where your dental savings plan becomes a superhero. You can switch to using your savings plan for discounts on any remaining care, ensuring you don't have to delay necessary treatment.

-

For Services Your Insurance Doesn't Cover: Many insurance policies have limitations, especially for cosmetic procedures, some orthodontics, or dental implants. If your insurance doesn't cover a procedure you want or need, your savings plan can offer significant financial relief. You can apply your savings plan discounts to procedures like:

- Cosmetic treatments like teeth whitening or porcelain veneers.

- Many types of dental implants.

- Certain specialized orthodontic treatments.

- Unique specialized treatments not covered by insurance.

-

During Your Insurance Waiting Period: If you've just enrolled in a new insurance plan, you might face a waiting period of several months for basic or major procedures. This is where your dental savings plan shines. Since savings plans have no waiting periods, you can get immediate discounts on major procedures while waiting for your insurance to become active. This allows you to receive timely care without paying the full, undiscounted cost.

By understanding these strategic applications, you can use both your dental insurance and a savings plan to create a flexible financial safety net for your oral health.

When Does It Make Sense to Have Both?

Investing in both a dental savings plan and traditional insurance can be a smart financial strategy, depending on your dental needs and financial situation. Carrying both is a savvy move in several common scenarios, especially with rising dental care costs in San Francisco.

You Anticipate Extensive Dental Work

If you know you have significant dental work on the horizon, having both types of coverage is incredibly helpful. Procedures like root canals, crowns, and dental implants add up quickly. A single crown can cost $750 to $2,000, and a root canal can cost $750 to over $1,000.

These costs can easily exceed the typical $1,000-$2,000 annual maximum on most insurance plans. When that happens, your insurance covers the initial part of your treatment up to its limit. Then, your dental savings plan can step in, providing valuable discounts on any remaining procedures. This combination means you keep getting reduced rates even after your insurance benefits are exhausted. At UNO Dental San Francisco, we help you understand all costs involved. Feel free to View our list of Dental Procedures to see the treatments we provide.

You Want Cosmetic Dentistry

Dreaming of a brighter smile? Cosmetic dentistry, like teeth whitening, porcelain veneers, or a smile makeover, is often considered elective by insurance and typically not covered.

If enhancing your smile is important to you, a dental savings plan is a game-changer. While your insurance covers preventive and necessary restorative work, your savings plan can offer valuable discounts on aesthetic procedures. This allows you to achieve your desired smile without facing the full, undiscounted cost. We invite you to explore our page on Dental Plans for Cosmetic Dentistry to see how we can help.

You Want to Bridge Gaps in Coverage

Good oral health is vital for your overall well-being. Poor oral health, like periodontal disease, is scientifically linked to serious systemic issues such as diabetes and cardiovascular disease. Delaying care due to financial worries can have long-term health consequences.

A dental savings plan acts as a vital safety net, ensuring you never have to put off crucial care due to insurance waiting periods, annual maximums, or exclusions. If you hit your annual maximum, your savings plan continues to provide savings. This dual approach gives you peace of mind, ensuring you're always covered and prioritizing your health. At UNO Dental San Francisco, we believe in proactive care, and a savings plan is an excellent tool for continuous access to treatment. For more on the connection between oral and systemic health, you can refer to Scientific research on Periodontal Disease as a Risk Factor.

Frequently Asked Questions About Dual Dental Coverage

Navigating dental benefits can be complex, and it's natural to have questions. At UNO Dental San Francisco, we want to help you make the best choices for your smile and wallet. Let's address common inquiries our San Francisco patients have about using both a dental savings plan and insurance.

Can I use a dental savings plan to pay for my insurance deductible?

No, you cannot use a dental savings plan to pay your insurance deductible. Your deductible is an amount you must pay toward services covered by your insurance before the insurance company contributes.

If you use your dental insurance for a procedure, your out-of-pocket payment goes toward your deductible. If you choose to use your savings plan for that same service, you receive a discount on the total cost, but that payment won't be applied to your insurance deductible. For each service, you must choose to either apply your insurance benefits or use your savings plan for a discount.

Do I need to tell my dentist I have both a dental savings plan and dental insurance?

Yes, absolutely! Informing our team at UNO Dental San Francisco that you have both allows us to be your best advocate. We can help you strategize the most effective way to use each plan to your advantage.

Our team can review your treatment plan, consider your insurance's annual maximums and waiting periods, and then advise whether it makes more financial sense to use your insurance or your savings plan for each procedure. Our goal is to provide transparent care and help you minimize your out-of-pocket costs.

Can I use a dental savings plan with dental insurance for orthodontics?

This is an excellent strategy, especially in San Francisco. Orthodontic treatment can be a significant investment. Many dental insurance plans offer some orthodontic coverage but often have limitations, such as a low lifetime maximum (perhaps only $1,000-$1,500) or age restrictions.

Here’s how you can combine both plans to make orthodontics more affordable:

First, use your dental insurance benefits up to its lifetime maximum. This initial contribution from your insurance will significantly reduce your out-of-pocket expense.

Then, once your insurance maximum is reached, you can switch to your dental savings plan. Your savings plan will provide a valuable discount on the remaining balance of your orthodontic treatment.

This dual approach can lower the financial burden of achieving a straighter, healthier smile, making it more accessible for you and your family.

Making the Right Choice for Your Smile and Wallet

Navigating dental benefits doesn't have to be overwhelming. As we've explored, the answer to can you use a dental savings plan with dental insurance is yes. Understanding how to use them together strategically can transform your approach to managing dental expenses.

The power lies in knowing when each plan serves you best. After your insurance hits its annual maximum, your savings plan provides continued discounts. For procedures your insurance won't cover, like a smile makeover, your savings plan offers immediate relief. During frustrating waiting periods, your savings plan gives you access to discounted care right away.

This personalized approach empowers you to take control of your oral health without the stress of unexpected costs. You can get the care you need while protecting your budget.

At UNO Dental San Francisco, we believe exceptional dental care should be accessible and transparent. We know financial concerns can prevent people from seeking treatment. Our high-tech, holistic approach means we look at the whole picture: your dental health, overall wellness, and financial reality. We have honest conversations about costs, help you understand your benefits, and create a treatment plan that fits your life.

Every patient's situation is unique. That's why we don't believe in one-size-fits-all solutions. We take the time to understand your needs and help you steer your financial options to achieve your health goals.

If you're looking for an affordable, straightforward alternative to traditional insurance—or a complement to your existing coverage—we invite you to explore our in-house Dental Savings Plan. It's designed for our patients, with no hidden fees, no complicated paperwork, and immediate access to discounted care. We're committed to making exceptional dental care accessible to all our San Francisco neighbors, because your smile shouldn't wait.