Why Finding the Best Dental Insurance for Cosmetic Dentistry Can Transform Your Smile Dreams

This article has been manually reviewed for accuracy and medical relevance by Dr. Mohammad Aghiad Kandar, DDS, UNO DENTAL SAN FRANCISCO.

The best dental insurance for cosmetic dentistry is often the missing piece between dreaming about your perfect smile and actually achieving it. While traditional dental insurance typically covers only medically necessary treatments, many cosmetic procedures fall into a gray area where coverage depends on specific circumstances and plan details.

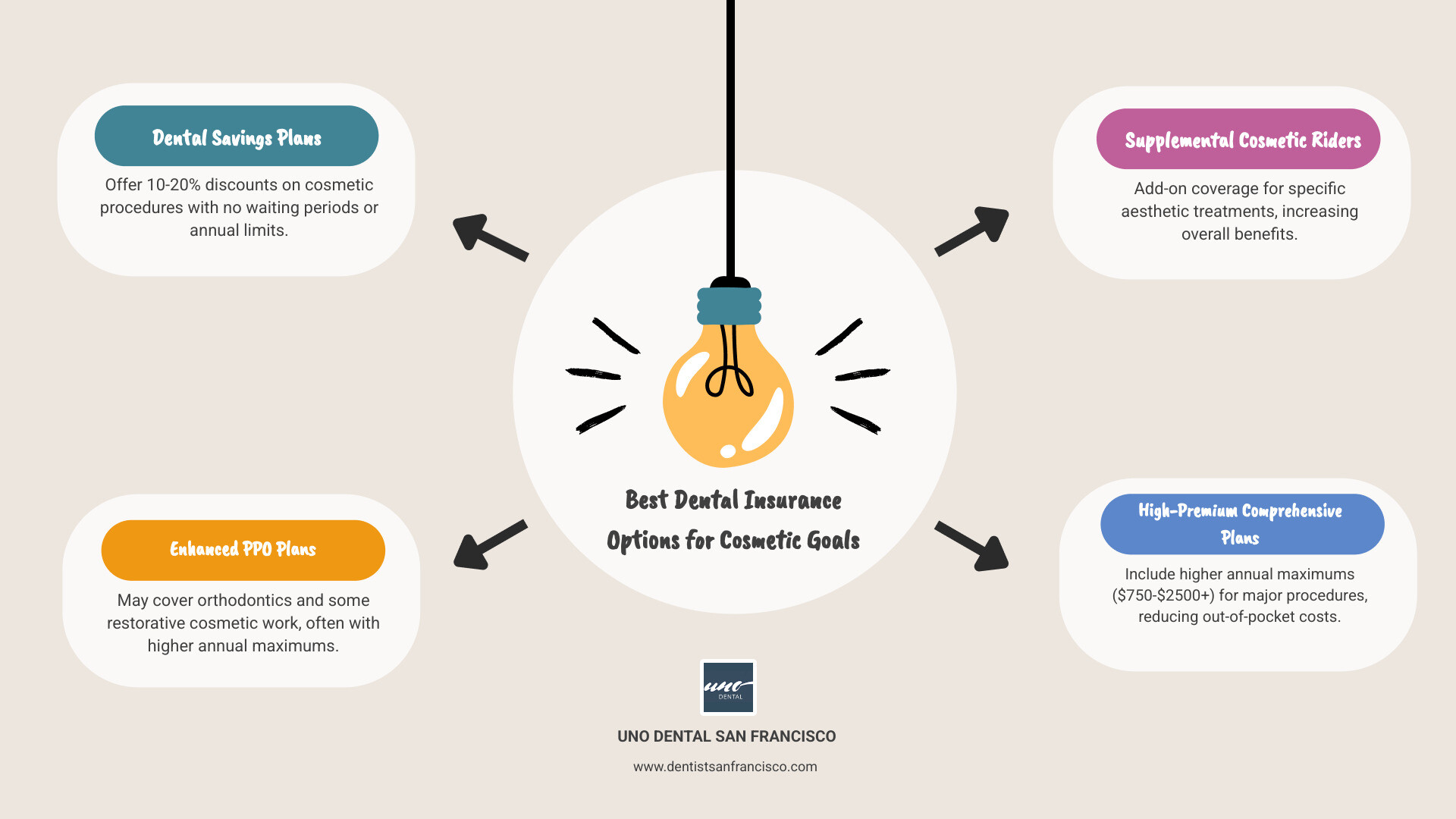

Quick Answer: Best Options for Cosmetic Dentistry Coverage:

- Dental Savings Plans - Offer 10-20% discounts on cosmetic procedures with no waiting periods

- Improved PPO Plans - May cover orthodontics and some restorative cosmetic work

- Supplemental Cosmetic Riders - Add-on coverage for specific aesthetic treatments

- High-Premium Comprehensive Plans - Include higher annual maximums for major procedures

Most people find too late that their standard dental insurance excludes purely cosmetic treatments like teeth whitening and aesthetic veneers. Yet some procedures like orthodontics, crowns, and certain veneers can qualify for coverage when they address functional issues beyond appearance.

The challenge lies in understanding which treatments might qualify, what plan types offer the best value, and how to maximize your benefits for smile-enhancing procedures.

As Dr. Mohammad Aghiad Kandar, DDS, with over 15 years of experience helping San Francisco patients steer insurance complexities for cosmetic treatments, I've seen how the right coverage strategy can make dream smiles financially accessible. My expertise in customizing treatment plans that balance aesthetic goals with insurance benefits has helped countless patients achieve their best dental insurance for cosmetic dentistry outcomes.

Best dental insurance for cosmetic dentistry word roundup:

Understanding the Landscape: Cosmetic Dentistry and Insurance Basics

Let's be honest – navigating cosmetic dentistry and insurance can feel like trying to solve a puzzle with half the pieces missing. The good news? Once you understand how insurance companies think about dental treatments, finding the best dental insurance for cosmetic dentistry becomes much clearer.

Cosmetic dentistry focuses on improving how your teeth and smile look, though many procedures also boost function and oral health. Think of it as the intersection where beauty meets function – and that's exactly where insurance coverage gets interesting.

The magic word in dental insurance is "medical necessity." This single concept determines whether you'll pay out of pocket or get help from your insurance. When a cosmetic procedure addresses a functional problem – like fixing a cracked tooth that causes pain or correcting a bite that affects chewing – insurance companies suddenly become much more cooperative.

Here's where it gets tricky: the same procedure can be covered or not covered depending on why you need it. A veneer to fix a damaged front tooth? Likely covered. The same veneer to make a perfectly healthy tooth look whiter? Probably not.

To explore the full range of possibilities for changing your smile, check out What Can Cosmetic Dentistry Do?.

Common cosmetic procedures fall into different categories when it comes to insurance coverage. Teeth whitening is almost always considered purely cosmetic – insurance companies see bright white teeth as nice-to-have, not need-to-have. Veneers can go either way: they're often covered when repairing damage but rarely when just improving appearance.

Dental bonding for minor chips might get partial coverage if the chip affects function, while gum contouring is typically an uphill battle with insurance unless there's a periodontal health component. Clear aligners and orthodontics often have the best coverage potential since crooked teeth can cause real functional problems like difficulty chewing or jaw pain.

The key to finding the best dental insurance for cosmetic dentistry is understanding this gray area between purely aesthetic treatments and those with legitimate functional benefits. Smart patients work with experienced dentists who know how to document medical necessity when it truly exists, maximizing insurance benefits while achieving their aesthetic goals.

The Great Divide: What Dental Insurance Typically Covers (and What It Doesn't)

Here's the reality check that catches most people off guard: dental insurance wasn't designed with your dream smile in mind. Traditional plans focus on keeping your teeth healthy and functional, not necessarily beautiful. Think of it as more of a "dental maintenance plan" than comprehensive coverage for aesthetic improvements.

The insurance world operates on a simple principle: they'll help pay for what you need, but not necessarily what you want. This creates what I call the great coverage divide, where procedures fall into distinct categories based on medical necessity rather than how much they'll boost your confidence.

Most plans follow a predictable pattern. Preventive care like cleanings gets the royal treatment with 80-100% coverage. Basic procedures like fillings typically see a 50:50 cost split between you and your insurance. But when we venture into major services - where many cosmetic procedures live - that copayment system often becomes less generous, sometimes dropping to 50% coverage or lower.

The tricky part? Purely cosmetic exclusions are standard across most plans, but there's often overlap where cosmetic procedures also provide functional benefits. This gray area is where smart patients can sometimes find coverage opportunities.

For a comprehensive look at your specific coverage possibilities, check out Will My Dental Insurance Cover Cosmetic Dentistry?.

Procedures Sometimes Covered (with Medical Necessity)

The magic words in dental insurance are "medical necessity." When a cosmetic procedure also solves a functional problem, insurance companies suddenly become much more interested in helping with the bill.

Veneers for cracked teeth represent a perfect example of this overlap. If your tooth is damaged from an accident or years of wear, a veneer isn't just making you look better - it's protecting what's left of your natural tooth structure. Insurance sees this as restoration, not just beautification. The key is documentation showing the underlying damage or functional issue.

Crowns for broken teeth follow similar logic. When a tooth is severely fractured or has undergone a root canal, a crown becomes essential for the tooth's survival. Yes, it'll look great, but its primary job is structural support. Most plans recognize this necessity.

Orthodontics for bite correction opens another coverage door. While straight teeth certainly look amazing, if your bite problems cause jaw pain, excessive tooth wear, or chewing difficulties, treatment becomes medically justified. Many plans offer orthodontic benefits with lifetime maximums, often around $1,000-$2,000.

Dental implants for tooth loss usually qualify when replacing teeth lost to decay, disease, or trauma. The implant restores your ability to chew properly and prevents bone loss - clear medical benefits beyond the obvious aesthetic improvement.

For specific information about veneer coverage, explore Dental Insurance That Covers Veneers.

Procedures Rarely Covered

On the flip side, some procedures are so clearly cosmetic that insurance companies won't budge, no matter how compelling your argument might be.

Teeth whitening tops this list. Whether you choose in-office treatment or professional take-home kits, whitening is considered purely aesthetic. Your teeth function just fine regardless of their shade, so insurance sees no medical reason to contribute.

Gum lifts for aesthetics fall into the same category. If you want to reduce a gummy smile or create more symmetrical gum lines purely for appearance, you'll be paying out of pocket. However, if gum reshaping is part of treating actual periodontal disease, that's a different story.

Veneers for purely cosmetic reasons get the exclusion treatment too. If your teeth are healthy but you simply want them whiter, straighter, or more uniform, insurance won't see the medical necessity. The same healthy teeth that function perfectly won't qualify for coverage help.

Dental bonding for minor chips that don't affect function or cause sensitivity typically won't receive coverage either. These small aesthetic improvements, while they might boost your confidence significantly, don't meet the medical necessity threshold.

Research confirms this pattern across the industry. A systematic review of dental insurance shows that coverage consistently prioritizes disease prevention and treatment over aesthetic improvement.

The best dental insurance for cosmetic dentistry often requires looking beyond traditional coverage models to find plans that acknowledge the growing importance of aesthetic dental care in overall well-being.

Finding the Best Dental Insurance for Cosmetic Dentistry: Key Plan Types to Consider

Navigating dental insurance for cosmetic procedures can feel overwhelming, but understanding your options makes all the difference. The best dental insurance for cosmetic dentistry isn't always traditional insurance at all – sometimes it's about finding creative alternatives that actually work for your smile goals.

Think of it this way: you wouldn't use a hammer to paint a wall, right? Similarly, traditional dental insurance wasn't designed with cosmetic dentistry in mind. That's why exploring different plan types – from PPO plans and HMO plans to dental savings plans and supplemental riders – can open up opportunities you might not have considered.

Traditional PPO/HMO Plans: The Standard Approach

Most of us are familiar with the usual suspects in dental insurance. PPO (Preferred Provider Organization) and HMO (Health Maintenance Organization) plans are the workhorses of dental coverage, typically offered through employers or available for individual purchase.

PPO plans give you more flexibility – you can visit any dentist, though staying in-network saves you money. You'll typically pay a deductible first, then the insurance covers a percentage of costs. HMO plans work differently, requiring you to choose a primary dentist from their network and get referrals for specialists. The trade-off? Usually lower premiums and predictable copayments.

Here's where it gets tricky for cosmetic work. Procedures that might have aesthetic benefits – like crowns, bridges, and sometimes implants – fall under the "major services" category. These typically come with a 50:50 cost split, meaning you're paying half the bill out of pocket.

The biggest hurdle? Annual maximums. Most traditional plans cap their yearly payouts between $750 and $2,500. When a single veneer can cost $1,000 or more, you can see how quickly you'd hit that ceiling. It's like trying to renovate your kitchen with a gift card to the hardware store – helpful, but probably not enough.

Waiting periods add another layer of complexity. Many plans make you wait 6 to 12 months before covering major services. If you're excited about your smile makeover, that's a long time to wait! For example, a typical PPO plan might require a full year before you can use major service benefits.

The good news? If you choose an in-network provider, you'll typically enjoy lower costs and simpler paperwork. Many PPO plans have extensive networks, making it easier to find quality care.

Dental Savings Plans: An Insurance Alternative for the best dental insurance for cosmetic dentistry

Here's where things get interesting for cosmetic dentistry enthusiasts. Dental savings plans aren't insurance at all – they're membership programs that can be game-changers for aesthetic treatments.

Think of them as a warehouse club membership, but for dental care. You pay an annual or monthly fee to join, then get discounted rates from participating dentists. No deductibles, no annual maximums, no claims to file – just straightforward savings.

The magic happens with percentage savings. Many plans offer up to 20% off cosmetic procedures. That $1,000 veneer? You could save $200 just by flashing your membership card. For extensive smile makeovers, these savings add up fast.

But here's the real kicker – no waiting periods. Sign up today, use your benefits tomorrow. This makes dental savings plans incredibly appealing for purely cosmetic work that traditional insurance rarely touches, like teeth whitening and aesthetic veneers.

Since there are no annual limits, you can save as much as you need throughout the year. Planning multiple procedures? A dental savings plan might be your best dental insurance for cosmetic dentistry solution. For comprehensive information about these alternatives, check out Dental Plans for Cosmetic Dentistry.

Supplemental Plans and Riders: Enhancing Your Coverage for the best dental insurance for cosmetic dentistry

Sometimes you need to get creative with coverage. Supplemental plans and riders are like adding extra features to your car – they improve what you already have.

Add-on coverage fills specific gaps in your existing plan. The most common is an orthodontic rider, perfect if your standard plan skimps on straightening benefits. These riders might cover a percentage of orthodontic costs with their own lifetime maximum.

Cosmetic dentistry riders are rarer but worth investigating if you have access to premium plan options. They might provide a small allowance or additional discounts for certain aesthetic procedures, though they typically come with higher premiums.

Some plans offer increased annual maximums through supplemental coverage. If you're planning extensive work that blends restorative and cosmetic benefits, this boost in coverage limits could be valuable.

Don't forget about alternative payment strategies either. Many providers offer financing options, and you can often use Flexible Spending Accounts (FSA) or Health Savings Accounts (HSA) for qualified dental expenses. These aren't insurance, but they're powerful tools for managing cosmetic treatment costs.

The key is matching your coverage strategy to your smile goals – because the best dental insurance for cosmetic dentistry is the one that actually helps you achieve the results you want.

How to Maximize Your Benefits and Make an Informed Choice

Making smart choices about dental insurance for cosmetic procedures doesn't have to feel overwhelming. With the right strategy, you can significantly reduce your out-of-pocket costs and turn your dream smile into reality. The key is understanding how to work within the system and make informed decisions about the best dental insurance for cosmetic dentistry for your specific needs.

The first step is getting a pre-determination of benefits before starting any major cosmetic procedure. This is like getting a preview of what your insurance will actually cover. Your dental team can submit your proposed treatment plan to your insurance company, and they'll provide a detailed estimate of coverage. This eliminates nasty surprises and helps you budget accurately for your treatment.

Don't skip reading your policy documents carefully. Yes, insurance paperwork can be boring, but it's worth the effort. Pay special attention to sections on exclusions, limitations, major services, and cosmetic procedures. These sections will clearly spell out what is and isn't covered, saving you from disappointment later.

Your dental team is your best ally in this process. We can help you understand the medical necessity aspect of your desired procedures and sometimes frame your treatment plan in a way that maximizes potential insurance coverage. We're also here to discuss payment plans and financing options when insurance coverage falls short. To get a better understanding of what you might expect to invest, check out our guide on the Cost of Cosmetic Dentistry.

Key Factors That Influence Your Coverage and Costs

Several important factors directly impact how much your dental insurance will cover and what you'll pay out of pocket. Understanding these elements helps you make better decisions about both your insurance choice and treatment timing.

Premiums are your monthly or annual insurance fees. While higher premiums often mean better coverage, this isn't always guaranteed. Sometimes you're paying more for brand recognition rather than actual benefits.

Deductibles are the amount you must pay before your insurance kicks in. A high-tier PPO plan, for example, might have a $100 deductible per person per calendar year. This applies to diagnostic, basic, and major services.

Coinsurance is your share of costs after meeting your deductible. For major services that include cosmetic components, you'll typically pay 50% while insurance covers the other half. This 50-50 split is standard across most traditional plans.

Annual maximums can be the biggest limiting factor for cosmetic dentistry. These caps range from $750 to $2,500 per year. If you're planning extensive cosmetic work, you might hit this limit with just one or two procedures.

Waiting periods can delay your treatment plans. While preventive care usually has no waiting period, major services often require you to wait 6-12 months after your policy starts. This is why planning ahead matters.

In-network providers offer the best value within traditional insurance plans. These dentists have agreed to discounted fees with your insurance company, which means lower costs for you and simpler billing processes.

Here's how traditional PPO plans compare to Dental Savings Plans:

| Feature | Traditional PPO Plans | Dental Savings Plans |

|---|---|---|

| Type | Insurance | Discount Program (Not insurance) |

| Premiums/Fees | Monthly/Annual Premiums | Annual/Monthly Membership Fee |

| Deductible | Yes, typically applies to basic & major services | No |

| Coinsurance | Yes, you pay a percentage (e.g., 20%, 50%) | No, you pay discounted rate directly |

| Annual Maximum | Yes, limits total payout (e.g., $750-$2500) | No, unlimited discounts |

| Waiting Periods | Common for basic/major services (e.g., 6-12 months) | Rare, usually immediate discounts |

| Coverage Focus | Medically necessary (preventive, basic, major restorative) | Discounts on all services, including cosmetic |

| Claims | Dentist files claims, insurer reimburses dentist/patient | No claims, you pay dentist discounted rate |

| Provider Choice | In-network lower cost, out-of-network higher cost | Network of participating dentists, all offer discounts |

The best dental insurance for cosmetic dentistry often depends on your specific goals and timeline. If you're planning multiple procedures or purely aesthetic treatments, dental savings plans might offer better value than traditional insurance. However, if you need procedures that blend restorative and cosmetic benefits, a good PPO plan might provide the coverage you need.

Frequently Asked Questions about Cosmetic Dentistry Insurance

When it comes to the best dental insurance for cosmetic dentistry, we hear the same questions over and over in our San Francisco practice. Let's tackle the big ones that keep our patients up at night.

Are veneers ever covered by dental insurance?

Here's the good news: yes, veneers can sometimes be covered by dental insurance! But there's a catch – they need to serve a medical purpose beyond just making your smile look amazing.

Think of it this way: if your tooth is chipped, cracked, or damaged from decay, and that damage affects how you chew or causes sensitivity, then a veneer isn't just cosmetic anymore. It's actually restoring your tooth's function and protecting it from further problems. In these cases, your insurance might cover a portion of the cost, treating it as a restorative procedure rather than a purely cosmetic one.

However, if you want veneers simply to achieve that Hollywood smile on perfectly healthy teeth, insurance will likely consider this elective and won't provide coverage. The key is demonstrating medical necessity – something we help our patients understand during consultations.

For more detailed information about what to expect with porcelain veneers, check out our Porcelain Veneers FAQ.

Does insurance cover professional teeth whitening?

Unfortunately, this is where we have to deliver some disappointing news. Professional teeth whitening is almost never covered by dental insurance, whether it's done in our office or with take-home kits we provide.

The reason is straightforward: teeth whitening is considered purely cosmetic. It doesn't treat disease, restore function, or address any medical concern. Its sole purpose is to make your teeth brighter and whiter, which insurance companies classify as elective.

This means you should plan to pay for teeth whitening entirely out-of-pocket. The silver lining? Since it's not tied to insurance restrictions, we can often offer flexible payment options and special promotions to make professional whitening more affordable.

Can I get a plan that covers cosmetic dentistry with no waiting period?

This is where dental savings plans really shine! Unlike traditional insurance, most dental savings plans have no waiting periods at all. You can literally sign up today and start receiving discounts on cosmetic procedures immediately.

Traditional dental insurance plans often impose waiting periods that can stretch up to 12 months for major services. This means even if your cosmetic procedure qualifies for some coverage, you might have to wait a full year before that coverage kicks in.

Dental savings plans offer a different approach entirely. Since they're discount programs rather than insurance, there's no waiting around. You pay your membership fee, and you're immediately eligible for reduced rates on cosmetic treatments.

Some high-premium traditional insurance plans do offer shorter waiting periods or none at all for major services, but these come with significantly higher monthly costs. For most people seeking cosmetic dentistry, the immediate access provided by dental savings plans makes them the more practical choice.

The bottom line? If you're ready to start your smile change now rather than waiting months for coverage to begin, a dental savings plan is typically your fastest path to savings on cosmetic procedures.

Your Partner in Achieving Your Dream Smile

Finding the best dental insurance for cosmetic dentistry doesn't have to feel like solving a puzzle. At UNO DENTAL SAN FRANCISCO, we've helped countless patients steer these insurance complexities while achieving their aesthetic goals affordably.

The truth is, achieving your dream smile involves more than just expert dental care – it requires smart financial planning too. That's where our personalized approach makes all the difference. We don't just focus on your teeth; we consider your insurance benefits, budget constraints, and aesthetic desires to create a treatment plan that works for your life.

Our team has over 15 years of experience helping San Francisco patients maximize their dental benefits for cosmetic treatments. We know which procedures might qualify for coverage, how to present treatment plans to insurance companies, and when alternative financing makes more sense than traditional insurance.

What sets us apart is our commitment to individualized treatment planning. During your consultation, we'll review your current insurance coverage, explain what might be covered, and explore all your options – from maximizing existing benefits to dental savings plans that offer immediate discounts on cosmetic work.

We believe everyone deserves to feel confident about their smile, regardless of their insurance situation. That's why we offer comprehensive, patient-centered dental services with a focus on high-tech, holistic care, all under one roof. Whether your insurance covers part of your treatment or you're paying out-of-pocket, we'll help you find an affordable path to your goals.

Don't let insurance confusion keep you from the smile you've always wanted. We invite you to take advantage of our free virtual smile consultations, where you can discuss your goals and explore options from the comfort of your home. During this consultation, we'll help you understand your insurance benefits and craft a personalized financial plan for your cosmetic dentistry journey.

Ready to transform your smile dreams into reality? Find the right dental plan for your cosmetic goals and let us guide you every step of the way toward achieving the best dental insurance for cosmetic dentistry outcome for your unique situation.