Why Understanding Cosmetic Dentistry Coverage Matters

Dental insurance plans that cover cosmetic dentistry can be surprisingly hard to find, but the right coverage can save you thousands on your dream smile. Most people find too late that their standard dental plan doesn't cover veneers, teeth whitening, or other aesthetic procedures they want.

Here's what you need to know about cosmetic dentistry coverage:

- Most procedures are excluded - Standard plans typically don't cover purely cosmetic treatments

- Medical necessity is key - Procedures must address functional issues or oral health problems

- Improved plans offer better options - Premium tiers may cover 50-60% of restorative work with cosmetic benefits

- Orthodontics may be covered - Braces and Invisalign often qualify when treating malocclusion

- Alternative financing exists - HSAs, FSAs, and payment plans can bridge coverage gaps

The challenge isn't just finding coverage - it's understanding the complex rules around what qualifies as "medically necessary" versus purely cosmetic. While dental insurance covers cosmetic dentistry dental procedures like veneers and teeth straightening in some cases, they must be deemed necessary for function or oral health.

Why does this matter? A single veneer can cost $1,000-$2,500, and a full smile makeover can reach $20,000 or more. Even partial coverage can make a significant difference in your budget.

As Mohammad Aghiad Kandar DDS at UNO DENTAL SAN FRANCISCO, I've helped hundreds of patients steer the complexities of dental insurance plans that cover cosmetic dentistry over my 15+ years in practice. My experience with insurance pre-authorization and treatment planning has shown me exactly which procedures qualify for coverage and how to maximize your benefits.

To learn more about financing specific treatments, explore our guides on:

What is Cosmetic Dentistry and Is It Covered by Insurance?

Cosmetic dentistry focuses on improving how your teeth, gums, and smile look - though it often does much more than that. These treatments range from simple teeth whitening to complete smile makeovers, and they're becoming more popular as people realize how much a confident smile can change their lives.

Here's the tricky part about dental insurance plans that cover cosmetic dentistry: most don't. Traditional dental insurance was designed to cover what's "medically necessary" - treating disease, fixing damage, or restoring function. If a procedure is purely for looks, it's usually considered elective and won't be covered.

But here's where it gets interesting. The line between cosmetic and restorative isn't always clear. Sometimes a treatment that makes your smile look amazing also fixes a real problem. For example, straightening crooked teeth doesn't just improve your appearance - it can make cleaning easier and prevent future problems.

That's why understanding the difference between cosmetic and restorative dentistry matters so much for your wallet. A procedure might qualify for coverage if it addresses functional issues, even if it also makes you look great. To learn more about how these treatments can transform both your smile and oral health, check out What Can Cosmetic Dentistry Do?. You can also explore our comprehensive cosmetic dentistry services to see your options.

The Critical Role of 'Medical Necessity'

Medical necessity is the magic phrase that can make or break your insurance coverage. Insurance companies define it as treatment that's required to diagnose, treat, or prevent a health problem - and that follows accepted dental standards.

Think of it this way: if your tooth problem affects how you chew, speak, or maintain good oral health, there's a good chance it's medically necessary. A crooked tooth that's causing excessive wear on other teeth? That's functional. A crown needed because of extensive decay? Definitely restorative, even though it'll look great.

Your dentist's documentation is crucial here. Detailed notes explaining why a procedure is medically necessary, backed up by X-rays and photos, can make the difference between coverage and paying out of pocket. This is especially important for accident-related injuries, which often have better coverage.

Pre-authorization is your friend. This means getting approval from your insurance company before treatment starts. It might seem like extra paperwork, but it prevents nasty surprises when the bill arrives. At UNO DENTAL SAN FRANCISCO, we help our patients steer this process to maximize their benefits.

For more detailed information about what qualifies for coverage, read Will my Dental Insurance Cover Cosmetic Dentistry?.

Common Procedures and Their Typical Classification

Let's break down how insurance companies typically view popular cosmetic procedures:

Teeth Whitening is almost always classified as purely cosmetic. Since it only changes the color of your teeth for appearance, don't expect coverage.

Veneers usually fall into the cosmetic category, but there are exceptions. If a veneer is restoring a severely damaged tooth from an accident and no cheaper option would work, you might get partial coverage. Otherwise, they're typically excluded.

Dental Bonding works similarly to veneers. When it's repairing a chipped tooth or closing a gap for functional reasons, there might be coverage. For purely aesthetic reshaping, probably not.

Crowns are generally considered restorative since they're usually needed for damaged teeth. They're typically covered under major dental benefits at around 50%, even though they dramatically improve appearance.

Clear aligners and braces are fascinating because they offer huge cosmetic benefits but often qualify for coverage. If they're correcting a bad bite that affects function or causes other problems, many improved plans offer partial coverage - especially for children.

Dental Implants are classified as major restorative procedures since they replace missing teeth and restore function. Many advanced plans offer 50% coverage after a waiting period, though some basic plans exclude them entirely.

The key is understanding that even procedures with amazing cosmetic results can qualify for coverage if they also address functional problems or restore oral health.

How to Find Dental Insurance Plans That Cover Cosmetic Dentistry

Finding dental insurance plans that cover cosmetic dentistry requires patience and detective work, but the effort can save you thousands on your smile change. The challenge isn't just finding any plan - it's understanding the fine print that separates plans that might help from those that definitely won't.

Most dental insurance comes with built-in limitations that directly impact your coverage. Annual maximums, which cap how much your insurer will pay in a calendar year, typically range from $1,000 to $2,500. That might sound generous until you realize a single crown costs $1,000-$1,500, and a full smile makeover can easily exceed $20,000.

Waiting periods add another layer of complexity. You'll typically wait six months for basic services coverage and a full year before major services kick in. This means planning ahead is essential - you can't sign up for coverage today and expect help with your veneers next month.

PPO plans generally offer your best shot at cosmetic coverage compared to HMO options. With a PPO, you can choose any licensed dentist, though staying in-network saves money. HMOs require you to pick from a specific network but often have lower out-of-pocket costs. The trade-off? Less flexibility and sometimes more restrictive coverage for specialized cosmetic services.

Understanding these plan structures helps you make informed decisions about which type might work best for your cosmetic goals. For deeper insights into how dental insurance works broadly, A systematic review of dental insurance coverage provides valuable academic perspective.

Decoding Plan Tiers: Basic vs. Improved Coverage

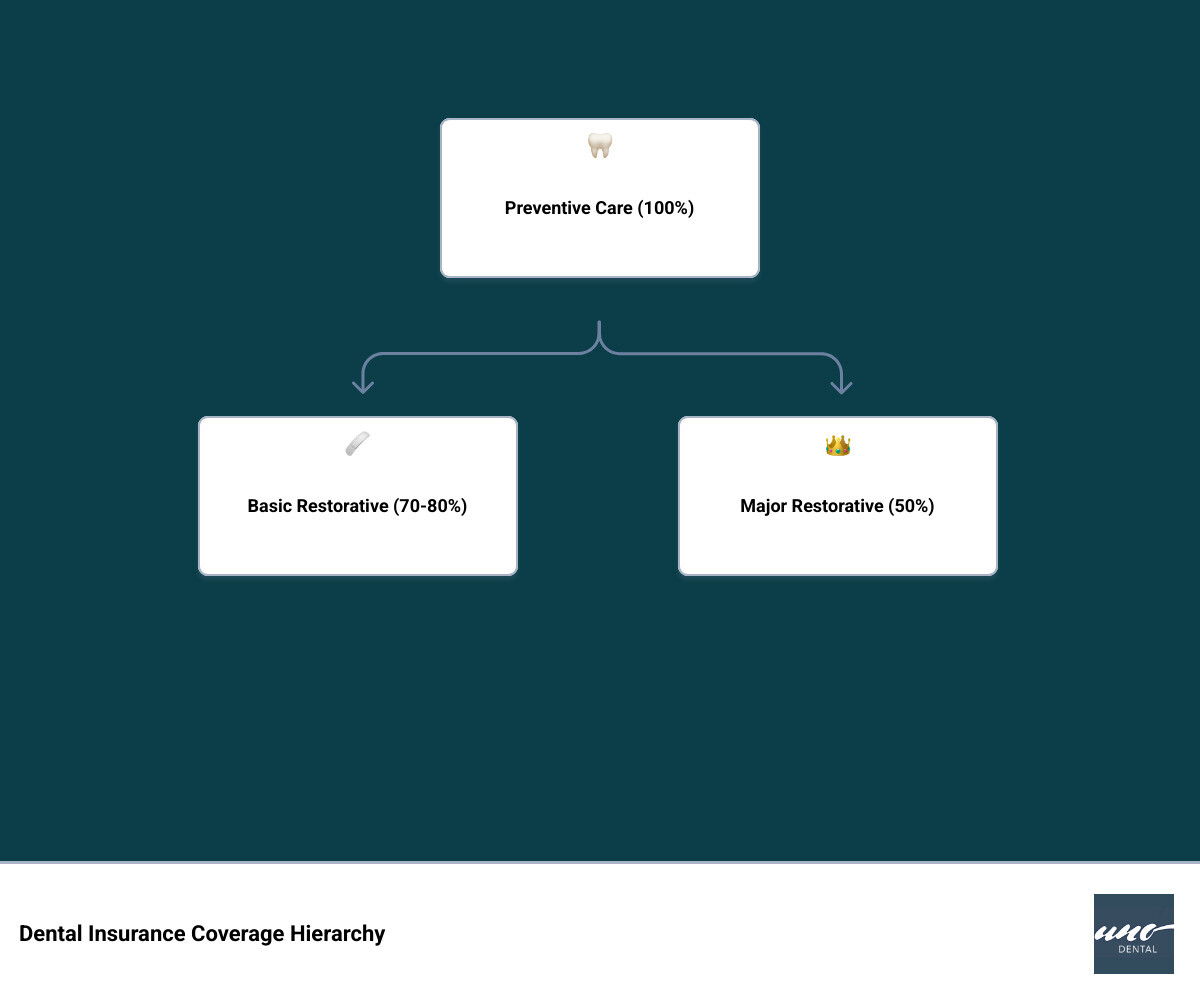

The dental insurance world operates on what's commonly called the "100-80-50 rule" - and understanding this structure is crucial for finding coverage that might help with cosmetic procedures.

Preventive care gets 100% coverage across almost all plans. Your cleanings, exams, and routine X-rays are fully covered because insurers know preventing problems costs less than fixing them later.

Basic services typically receive 70-80% coverage. This includes fillings, simple extractions, and emergency treatments. Even entry-level plans usually offer solid coverage here.

Major services drop to 50% coverage or less - and this is where things get interesting for cosmetic dentistry. Major services include crowns, bridges, root canals, and dental implants. While these are primarily restorative, many have significant cosmetic benefits.

The difference between basic and improved plans becomes crystal clear in this major services category. A basic plan might offer zero coverage for crowns, while an improved plan covers 50% after you've waited through the 12-month waiting period.

Here's how basic versus improved plans typically handle procedures with cosmetic benefits:

| Procedure Category | Basic Plan Coverage | Improved Plan Coverage |

|---|---|---|

| Preventive Care | 100% | 100% |

| Basic Services | 70% | 80% |

| Major Restorative (Crowns) | 0% or very limited | 50% (after waiting period) |

| Orthodontics | Usually excluded | 50-60% (with lifetime maximum) |

| Purely Cosmetic | 0% | 0% |

Improved plans shine brightest with orthodontics. While basic plans typically exclude braces and clear aligners entirely, improved plans often cover 50-60% of costs, subject to lifetime maximums ranging from $1,000 to $1,500.

Key Questions to Ask Your Insurance Provider

Getting straight answers from insurance companies requires asking the right questions. I've learned from years of helping patients steer coverage that being specific gets you accurate information. Here's what to ask:

- Request your complete plan documents. Ask for your Summary of Benefits and Coverage plus the full list of exclusions. These documents contain the real rules governing your coverage, not just the marketing highlights.

- Get specific about procedure codes. Every dental procedure has a CDT (Current Dental Terminology) code. When you ask "Are clear aligners covered?" you might get a vague answer. When you ask "Is CDT code D8080 covered under my orthodontic benefits?" you'll get a definitive yes or no.

- Understand their definition of medical necessity. This is where coverage decisions are won or lost. Ask exactly what documentation they need to consider a procedure medically necessary rather than purely cosmetic. Some insurers require specific clinical findings, while others focus on functional impairment.

- Clarify all limitations upfront. Find out about waiting periods, annual maximums, and lifetime maximums for each category of service. Ask specifically about the difference between in-network and out-of-network costs, especially if you have a preferred dentist.

- Press for specifics about similar procedures. Ask how they distinguish between crowns and veneers, or between medically necessary orthodontics and cosmetic alignment. Understanding these distinctions helps us document your case properly for the best chance of approval.

Are there specific dental insurance plans that cover cosmetic dentistry?

While no insurance plan covers purely cosmetic procedures, certain dental insurance plans that cover cosmetic dentistry do exist when the procedures serve dual purposes - both functional and aesthetic.

Premium PPO plans offer the most promise. These plans typically provide better coverage for major restorative services that happen to improve appearance. Look for plans offering 50% coverage on major services with annual maximums of $2,000 or higher.

Orthodontic riders make a real difference for teeth straightening. Some employer-sponsored plans include orthodontic benefits, while individual plans may offer them as add-ons. These benefits often distinguish between adult and child treatment, with lifetime maximums typically ranging from $1,000 to $1,500.

Focus on plans with robust major services coverage. The key is finding plans that classify procedures like crowns, bridges, and implants as covered major services rather than excluded cosmetic treatments. When these restorative procedures also improve appearance, you get cosmetic benefits through the back door.

The most important advice I can give is to read the actual plan documents, not just the summary brochures. Look specifically at what's covered under "major services" and scrutinize the exclusions list. Pay special attention to how they define "medically necessary" versus "cosmetic."

For procedures like veneers that might serve both cosmetic and restorative purposes, proper documentation by your dental team becomes crucial. We work hard to present cases in ways that emphasize functional necessity when appropriate. If you're specifically interested in veneer coverage, our detailed guide on Dental Insurance That Covers Veneers provides additional insights.

Smart Financing When Insurance Isn't Enough

Even the most comprehensive dental insurance plans that cover cosmetic dentistry will likely leave you with some out-of-pocket expenses. Coverage gaps are common - whether it's your annual maximum being reached, waiting periods for major procedures, or purely cosmetic treatments that simply aren't covered at all. The good news? These gaps don't have to derail your dream of a perfect smile.

At UNO DENTAL SAN FRANCISCO, we've seen countless patients transform their smiles using creative financing solutions. The key is understanding your options and planning ahead. While a complete smile makeover might seem financially out of reach, breaking it down into manageable payments often makes it surprisingly affordable. For a detailed breakdown of what you might expect to invest, check out our guide on the Cost of Cosmetic Dentistry.

Taking control of your dental care costs means thinking beyond traditional insurance. Whether you're looking at veneers, clear aligners, or teeth whitening, there are several paths to make these treatments fit your budget.

Health Savings Accounts (HSA) & Flexible Spending Accounts (FSA)

These tax-advantaged accounts are like hidden gems in healthcare financing. Many patients don't realize how powerful these tools can be for cosmetic dental procedures.

Health Savings Accounts (HSAs) work beautifully for dental expenses. If you have a high-deductible health plan, you can contribute pre-tax dollars to your HSA and watch them grow tax-free. The best part? You can withdraw funds tax-free for qualified medical expenses, which includes most dental treatments. Even procedures that insurance considers "cosmetic" may qualify if your dentist documents medical necessity.

Flexible Spending Accounts (FSAs) operate similarly but through your employer. You set aside pre-tax money from each paycheck, immediately reducing your taxable income. The catch is the "use it or lose it" rule - you typically need to spend these funds within the plan year, though some employers offer grace periods.

Both accounts essentially give you an instant discount equal to your tax rate. If you're in a 25% tax bracket, that $2,000 veneer procedure effectively costs you $1,500 when paid with pre-tax dollars. We provide detailed receipts and documentation to make your reimbursement process smooth and hassle-free.

Third-Party Financing and In-House Plans

When insurance coverage isn't enough, several financing options can bridge the gap and make your ideal smile achievable:

- Third-Party Financing: Specialized credit cards designed for healthcare expenses are a popular option. They often feature promotional periods where you pay zero interest if the balance is paid off within an agreed timeframe (typically 6-24 months). For larger procedures, they may offer longer-term plans with fixed interest rates, and the application process is often instant.

- Personal Medical Loans: Another route is to secure a personal loan specifically for medical and dental expenses. These loans usually have fixed rates and predictable monthly payments, making it easier to budget for more extensive cosmetic work.

- In-house Dental Membership Plans: Our membership plan offers a completely different approach. Instead of dealing with insurance complexities, you pay an annual fee for significant discounts on all services, from cleanings to major cosmetic procedures, plus priority scheduling and personalized care planning.

- Office Payment Plans: For qualifying treatments, we can arrange custom payment schedules that work with your budget. This provides the ultimate flexibility, allowing you to spread costs over several months or time treatments around your financial calendar.

The beauty of these options is that they put you in control. Instead of waiting for insurance approval or dealing with coverage limitations, you can move forward with your treatment plan on your timeline. For a comprehensive look at all your financing alternatives, explore our detailed guide on Making Dental Care Affordable: Alternatives to Dental Insurance.

At UNO DENTAL SAN FRANCISCO, we believe financial concerns shouldn't stand between you and the smile you deserve. That's why we work closely with each patient to find the financing solution that makes sense for their situation and goals.

Frequently Asked Questions about Cosmetic Dentistry Coverage

Let's tackle the questions we hear most often in our San Francisco office. These real-world scenarios help clarify how dental insurance plans that cover cosmetic dentistry actually work in practice.

Are braces or clear aligners covered by insurance?

Here's some encouraging news: braces and clear aligners are often partially covered by dental insurance, especially if you have an improved or premium plan. The secret ingredient? Medical necessity.

When orthodontic treatment corrects a malocclusion (fancy term for "bad bite") that affects your health or daily life, insurance companies take notice. We're talking about situations where crooked teeth make it hard to chew properly, cause speech problems, create excessive tooth wear, or make cleaning so difficult that you're at risk for decay and gum disease.

Most employer-sponsored plans include orthodontic benefits with lifetime maximums ranging from $1,000 to $2,000. Some plans are more generous with children's orthodontics, while others treat adults and kids equally. For instance, you might see coverage that pays 60% of orthodontic costs up to a $1,500 lifetime maximum, or 50% coverage with a $2,000 annual cap.

The fine print matters here. Some plans have waiting periods before orthodontic benefits kick in, and others may cover traditional braces but exclude clear aligners. Always check your specific plan's benefits booklet and ask about pre-authorization requirements.

The effectiveness of clear aligners is well-supported. A scientific review of clear aligner effectiveness confirms these devices deliver real results for dental movement.

My tooth is chipped. Will insurance pay for a veneer?

Ah, the classic "maybe" scenario! Whether insurance covers your veneer depends entirely on why you need it and how significantly that chip affects your tooth's health and function.

If your chip is substantial enough to compromise your tooth's structure, cause sensitivity, or make chewing uncomfortable, a veneer might be considered medically necessary. Insurance companies are particularly sympathetic to accident-related injuries, and many policies have specific provisions for dental trauma.

However, if you have a tiny cosmetic chip that doesn't affect how your tooth works, and you simply want it to look perfect again, insurance will likely pass on covering a veneer. In these cases, dental bonding might be a more coverage-friendly alternative since it's less expensive and can still restore minor functional issues.

Pre-authorization is absolutely key in these situations. We'll document the extent of your chip, explain how it impacts your oral health, and justify why a veneer is the most appropriate treatment. This paperwork might seem tedious, but it's your best shot at coverage.

The bottom line? If your chipped tooth is causing problems beyond appearance, you have a much better chance of getting help from your insurance company.

What about dental implants?

Dental implants occupy a sweet spot in the insurance world because they're clearly restorative rather than purely cosmetic. Missing teeth affect your ability to chew, speak, and maintain proper oral health, making implants a functional necessity rather than a vanity project.

Most improved dental plans classify implants as major restorative procedures, typically covering around 50% of the cost after you meet your deductible. This classification puts them in the same category as crowns and bridges, which is good news for your wallet.

But there are some problems to steer. Waiting periods are almost universal for implant coverage, often lasting 12 months or more from when you first enroll. Annual maximums can also be limiting factors since a single implant can easily exceed many plans' yearly caps of $1,000 to $2,500.

Some basic plans explicitly exclude implants, along with related procedures like bone grafts and ridge augmentation. This is especially common in government-funded programs and bare-bones private plans.

Despite these potential limitations, if you're dealing with missing teeth, implants are worth exploring. We can help you understand the restorative benefits and work with your insurance provider to maximize any available coverage. The functional improvement to your life often makes the investment worthwhile, even with partial coverage.

Your Path to a Confident Smile in San Francisco

Finding the right dental insurance plans that cover cosmetic dentistry doesn't have to feel like an impossible puzzle. Throughout this guide, we've explored the intricate world of dental insurance coverage, and while the landscape can seem daunting, the key insights are actually quite straightforward.

Medical necessity remains the golden thread that runs through every coverage decision. When a cosmetic procedure also addresses a functional problem - whether it's fixing a chipped tooth that affects your bite, straightening teeth that make cleaning difficult, or replacing a crown that's both protective and beautiful - insurance companies are far more likely to provide coverage.

The distinction between basic and improved dental plans makes a real difference in your wallet. While basic plans might leave you paying full price for major restorative work, improved plans can cover 50% or more of procedures like crowns, bridges, and orthodontics that dramatically improve your smile's appearance while restoring function.

But here's what we've learned after helping hundreds of San Francisco patients steer these waters: insurance doesn't have to be your only path forward. HSAs and FSAs turn your pre-tax dollars into powerful tools for cosmetic dentistry. Third-party financing can make even extensive smile makeovers surprisingly manageable. Our in-house membership plans offer another route to quality care without the complexity of traditional insurance.

At UNO DENTAL SAN FRANCISCO, we've built our practice around understanding these complexities so you don't have to. Our free virtual smile consultations let you explore your options from the comfort of your home, and our high-tech, holistic approach means we can often find creative solutions that maximize both your insurance benefits and your satisfaction with treatment.

Your dream smile is closer than you think. Whether your insurance covers 50% of your treatment or you're exploring alternative financing, we're here to guide you through every step. Our individualized approach means we'll work with your specific insurance plan, help with pre-authorizations, and explore every avenue to make quality dental care accessible.

The journey to a more confident smile starts with understanding your options. Let's have that conversation and find how we can bring your ideal smile within reach, regardless of your insurance situation.

Explore your options and learn more about dental plans for cosmetic dentistry