Why Understanding Your Dental Plan for Adults Matters

Medically reviewed by Dr. Mohammad Aghiad Kandar, DDS - UNO DENTAL SAN FRANCISCO

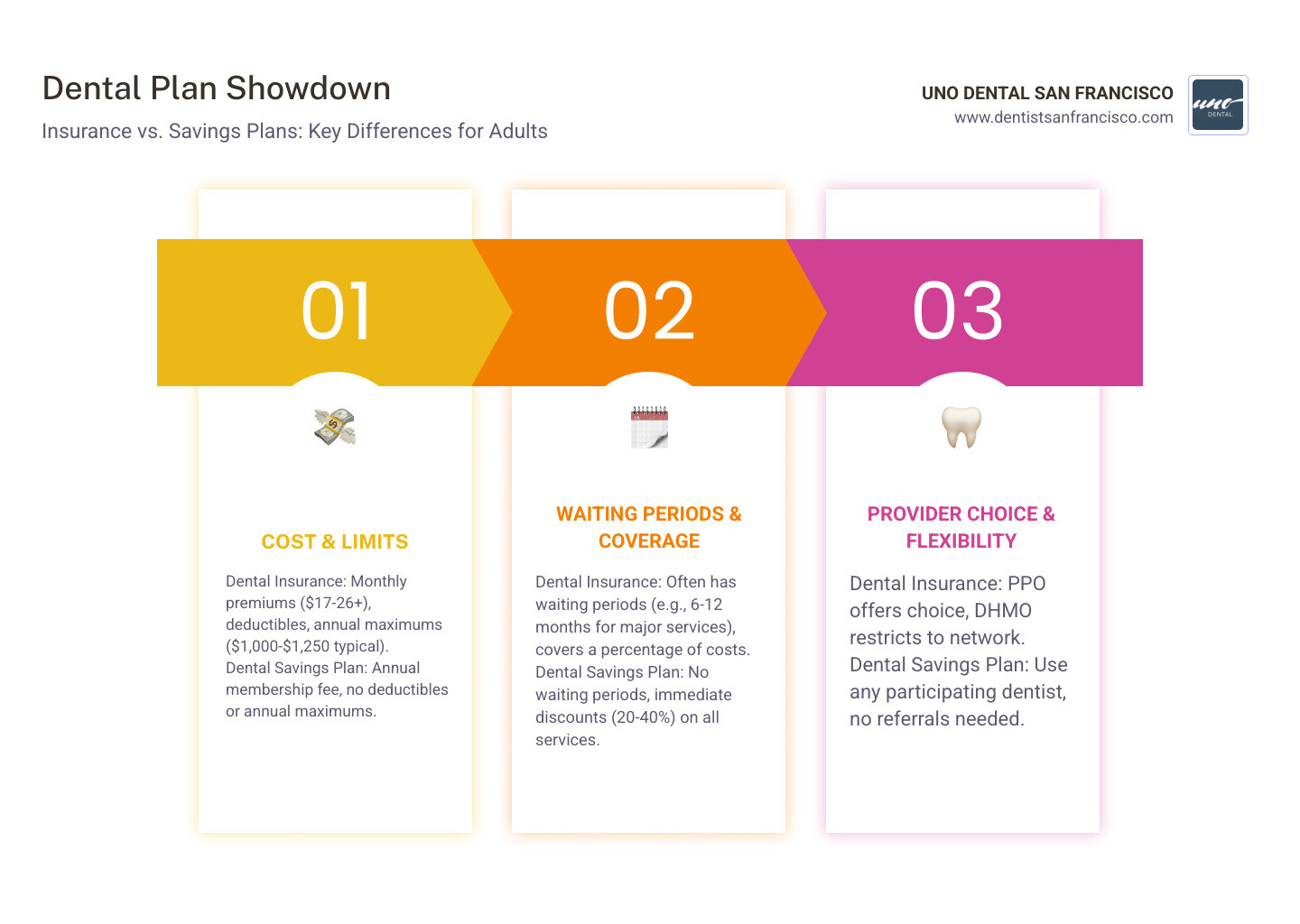

A dental plan for adults can be the difference between getting the care you need and putting off treatment due to cost. In the U.S., where dental coverage isn't an essential health benefit for adults, many face financial barriers. Unlike health insurance, dental plans often have annual maximums (typically $1,000-$1,250), waiting periods, and complex coverage rules that can lead to surprise costs.

Quick Answer: Types of Adult Dental Plans

- PPO Plans - Choose any dentist, lower costs in-network, typically $18-$26/month

- DHMO Plans - Network-restricted, lowest premiums starting at $17/month, no annual maximums

- Dental Savings Plans - Annual membership fee for 20-40% discounts, no waiting periods

- Marketplace Plans - Separate from health insurance, may have waiting periods for adults

- Public Programs - Limited adult coverage through Medicaid (varies by state)

The good news is that you have more options than ever. Beyond traditional insurance, alternatives like dental savings memberships and HSA/FSA accounts make quality care accessible without the confusion of claims and coverage limits.

Your oral health directly impacts your overall wellness, with established links to cardiovascular disease, diabetes complications, and stroke. Yet financial barriers prevent many adults from getting the preventive care that could save them thousands in the long run.

As Dr. Mohammad Aghiad Kandar at UNO DENTAL SAN FRANCISCO, I've spent over 15 years helping patients steer the complexities of dental plan for adults options, from traditional insurance to flexible in-house alternatives. My goal is to clarify what each option truly offers so you can make the best choice for your health and budget.

Understanding the Core Components of Dental Insurance

When evaluating a dental plan for adults, understanding a few key terms will help you compare options and avoid surprises.

- Premium: The fixed monthly amount you pay to maintain your plan.

- Deductible: The amount you pay out-of-pocket (e.g., $50) before insurance begins to pay. Preventive care is often exempt.

- Coinsurance: The percentage of costs you share with your insurer after meeting your deductible. For a $100 filling with 70% coverage, you'd pay $30.

- Copayment: A fixed fee you pay for a service, common in DHMO plans.

- Annual Maximum: The total amount an insurance plan will pay in a year, typically $1,000-$1,250. You are responsible for all costs beyond this limit.

- In-Network vs. Out-of-Network: In-network dentists have pre-negotiated rates with your insurer, resulting in lower costs for you. Out-of-network dentists do not, which means higher out-of-pocket expenses.

At UNO DENTAL, we are in-network with several major PPO plans. We also accept many other PPO plans as out-of-network providers and handle claim submissions for you.

Services are typically grouped into three tiers:

- Preventive Care: Cleanings, exams, and X-rays, usually covered at 80-100% with no waiting period.

- Basic Services: Fillings and simple extractions, often covered at 50-80% after your deductible.

- Major Services: Crowns, bridges, and dentures, covered at 20-50% and often subject to waiting periods.

What is a Dental Insurance Waiting Period?

A waiting period is a set time after enrolling in a dental plan for adults before certain services are covered. Insurers use them to prevent individuals from signing up only for immediate, expensive work.

While preventive care like cleanings often has no waiting period, other treatments do. Basic care (fillings, extractions) may have a one to six-month wait. Major services (crowns, bridges, dentures) almost always require a longer wait, typically six to twelve months.

If you're considering a plan through the Health Insurance Marketplace, be aware that adult dental plans can also include these waiting periods. Always read the fine print to avoid unexpected delays.

The Importance of Preventive Care

At UNO DENTAL, we see how preventive care transforms our patients' health and finances. Regular visits are an investment in your overall well-being.

Routine cleanings remove plaque and tartar that brushing misses, reducing your risk of cavities and gum disease. During dental exams, we check for early signs of decay, gum disease, and oral cancer. X-rays reveal issues hidden beneath the surface, like bone loss or decay between teeth.

The real value of preventive care is long-term savings. A simple filling costs a fraction of a root canal and crown, which become necessary when small problems go untreated. Good oral health also reduces your risk of serious conditions like cardiovascular disease. By prioritizing check-ups, you protect your health and avoid significant expenses. To learn more, visit our page on new patient dental insurance and financing.

Common Types of Dental Plans for Adults

Choosing the right dental plan for adults means understanding how different plans work. Most traditional insurance falls into two categories: PPO and DHMO. They represent different approaches to coverage, each with distinct advantages.

PPO (Preferred Provider Organization) Plans

PPO plans are the most common type of dental plan for adults, offering a balance of flexibility and savings.

The biggest advantage is freedom of choice. You can visit any licensed dentist, whether they are in-network or not. However, you'll pay significantly less out-of-pocket when you visit an in-network dentist who has agreed to pre-negotiated rates.

At UNO DENTAL, we are in-network with many major PPO plans, allowing patients with these plans to benefit from lower rates. We also accept many other PPO plans as out-of-network providers and will submit claims on your behalf.

Out-of-network visits are still covered but at a higher cost to you. PPO plans are ideal if you value choice and are willing to pay slightly higher premiums for that flexibility.

DHMO (Dental Health Maintenance Organization) Plans

DHMO plans operate as a managed care system with lower costs and more restrictions. We do not accept HMO plans at UNO DENTAL.

With a DHMO, you must choose a primary care dentist from a specific network who manages all your care, including referrals to specialists within that same network.

This limitation comes with financial benefits. DHMO plans typically have lower monthly premiums and often have no deductibles or annual maximums. Instead, you pay a set copayment for each service according to a fee schedule. The predictability of DHMO costs appeals to those who want to budget accurately.

The trade-off is choice. If you are comfortable selecting a dentist from a limited network, a DHMO can offer excellent value.

[TABLE] Comparing PPO vs. DHMO Plans

| Feature | PPO (Preferred Provider Organization) | DHMO (Dental Health Maintenance Organization) |

|---|---|---|

| Provider Choice | High flexibility; can see any licensed dentist (in-network or out-of-network) | Limited to a specific network of dentists; must choose a Primary Care Dentist (PCD) |

| Cost Structure | Higher premiums; deductible applies; coinsurance (e.g., 80/20, 50/50); annual maximum | Lower premiums; no deductible; no annual maximum; fixed copayments for services |

| Referrals | Not typically required for specialists | Required for specialists, who must be in-network |

| Out-of-Network | Covered, but at a higher cost | Generally not covered (except for emergencies) |

| Paperwork | Dentist's office usually files claims (especially in-network) | Minimal paperwork for the patient; PCD handles coordination |

| Best For | Individuals who value choice in dentists and are willing to pay more for flexibility | Individuals seeking lower premiums and predictable costs, comfortable with network restrictions |

Navigating Public and Marketplace Dental Coverage

Government-supported programs can be an option for a dental plan for adults, but it's crucial to understand their limitations, especially in California. Unlike children's benefits, adult dental coverage through these programs is often restricted.

Dental Coverage in the Health Insurance Marketplace

In the Health Insurance Marketplace, adult dental coverage is considered a non-essential benefit. This means you must actively seek it out, either as part of an integrated health plan or as a separate, stand-alone dental plan. You cannot purchase just a dental plan by itself through the Marketplace.

Be aware that these stand-alone plans for adults often come with waiting periods for non-preventive services. Before enrolling, always check the fine print on waiting periods, deductibles, and copayments. To compare your options, visit the official Healthcare.gov site where you can get details on plans available in your area.

State-Based Programs like Medicaid

In California, Medi-Cal (the state's Medicaid program) offers some dental coverage for adults with limited income, but the benefits are not comprehensive.

For adults 21 and over, Medi-Cal typically covers "problem-focused" care, such as limited exams, extractions, pain management, and dentures. These services address urgent issues rather than comprehensive or preventive care.

Some expanded benefits like cleanings and fillings may be available, but they usually require prior approval from the dental plan, which is not guaranteed and can delay treatment. It's also important to know that Medicaid benefits vary significantly from state to state.

At UNO DENTAL, we focus on working with private insurance and offering flexible alternatives. For general information on government programs, you can visit the Medicare Coverage Center, but note that Medicare generally does not cover routine dental care.

Are There Alternatives to a Traditional Dental Plan for Adults?

Insurance isn't the only path to affordable dental care. Many adults find better value and simplicity in alternatives that avoid the complexities of claims, waiting periods, and annual maximums. At UNO DENTAL, we help patients find straightforward access to quality care.

Dental Savings & Membership Plans

Dental savings plans are a simple alternative to insurance. You pay an annual membership fee directly to a dental office or plan provider in exchange for a percentage discount (often 20-40%) on services.

Key benefits include:

- No waiting periods: Start using your benefits immediately.

- No deductibles: Your discount applies from day one.

- No annual maximums: There's no cap on how much you can save.

These plans are ideal for those needing immediate work or who find insurance too complex. For example, the UNO DENTAL membership plan includes two cleanings, exams, and all necessary X-rays for one annual fee, plus a 20% discount on most other treatments. You can explore affordable alternatives to insurance on our website.

Using HSA & FSA for Dental Expenses

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) are tax-advantaged tools that can significantly reduce your out-of-pocket dental costs.

These accounts allow you to set aside pre-tax money to pay for qualified medical and dental expenses. This effectively gives you a discount equal to your tax rate. You can use HSA and FSA funds for everything from routine cleanings to major restorative work, including deductibles, copayments, and other out-of-pocket costs. At UNO DENTAL, we accept both and provide itemized invoices for easy reimbursement.

In-House Dental Payment Plans

When you need significant dental work, the cost can feel overwhelming. In-house dental payment plans offer a straightforward way to manage treatment costs directly with your provider.

Arranging payment terms directly with our office allows for flexible arrangements custom to your budget. This approach transforms a major investment into manageable monthly installments, which is especially helpful for procedures like crowns or implants that a traditional dental plan for adults may only partially cover.

At UNO DENTAL, we believe financial concerns shouldn't be a barrier to oral health. We offer various convenient payment options to make high-quality care accessible. Explore our specific dental payment plan options to find a solution that fits your needs.

Frequently Asked Questions About Adult Dental Plans

Choosing the right dental plan for adults raises many questions. Here are answers to some of the most common concerns we hear from patients.

What is the best dental plan for adults?

There is no single "best" dental plan for adults, as the right choice is highly personal. To find the best fit, consider these factors:

- Your Oral Health: Do you primarily need routine preventive care or major restorative work?

- Your Budget: Can you handle monthly premiums, or is a one-time annual fee for a savings plan better?

- Provider Choice: Is it important to keep your current dentist, or are you open to a limited network?

- Expected Needs: If you anticipate extensive treatment, an option without an annual maximum might offer more value.

Does dental insurance cover cosmetic procedures?

Most dental insurance plans do not cover cosmetic procedures. Insurance focuses on medically necessary treatments that address disease, injury, or functional problems. Services like teeth whitening or porcelain veneers for purely aesthetic reasons are considered elective and are typically excluded.

This doesn't mean cosmetic dentistry is out of reach. We can help you explore payment plans and other financing options. You can find out about plans for cosmetic dentistry on our website.

Can I get a dental plan with no waiting period?

Yes, several options offer immediate access to care. Dental savings plans, like our in-house UNO DENTAL membership, have no waiting periods. You can use your benefits for all services right away.

DHMO plans also frequently have no waiting periods, but they require you to use a dentist from their specific network.

Many PPO plans cover preventive care immediately, so you can get cleanings and exams right away, even if you have to wait for coverage on basic or major services. Always read the plan details to confirm when coverage for different types of services begins.

Conclusion

Choosing a dental plan for adults is about finding an approach that removes barriers to the care you deserve. Whether it's the flexibility of a PPO, the predictability of a savings plan, or the tax advantages of an HSA, the right option is the one that fits your life and budget.

At UNO DENTAL, we believe your care shouldn't be complicated. We are committed to helping you steer your options—from maximizing insurance benefits to exploring our comprehensive membership plan—so you feel informed, valued, and genuinely cared for. Your oral health is a vital part of your overall well-being, and we're here to ensure financial concerns don't stand in the way.

The next step is yours to take. We invite you to have an honest conversation with us about what will work best for you. No pressure, no confusing jargon—just a clear path toward your healthiest smile.

Your journey to better oral health starts with a simple decision. Discover our in-house Dental Savings Plan and see how straightforward dental care can be when it's designed with you in mind.