Why Finding the Right Coverage for Your Dream Smile Matters

Dental plans for cosmetic dentistry can be confusing to steer, but understanding your options is crucial for making your smile goals affordable. Most people find that standard dental insurance treats cosmetic procedures as "elective," leaving them to pay full price for treatments like veneers, teeth whitening, or clear aligners.

Quick Coverage Options for Cosmetic Dentistry:

- PPO Insurance with Cosmetic Riders - Limited coverage (typically 50-80%) for dual-purpose procedures

- Dental Savings Plans - 10-60% discounts on most cosmetic treatments, no waiting periods

- In-House Membership Plans - Annual fee plans offering preventative care plus cosmetic discounts

- Third-Party Financing - CareCredit, LendingClub for spreading costs over time

- HSA/FSA Accounts - Tax-advantaged funds for qualifying dental expenses

The reality is stark: professional teeth whitening ranges from approximately $342 to $1,026 CAD, porcelain veneers cost between $855 to $1,710 CAD per tooth, and a single dental implant can run between $3,420 to $5,130 CAD. Braces or clear aligners can range from $3,420 to $8,550 CAD. Without proper planning, these costs can quickly overwhelm your budget.

As Mohammad Aghiad Kandar DDS at UNO DENTAL SAN FRANCISCO, I've helped hundreds of patients steer dental plans for cosmetic dentistry over my 15+ years of practice, ensuring they understand both coverage limitations and creative financing solutions. My experience in complex treatment planning has shown me that the right combination of plans and financing can make any smile change achievable.

Why Standard Insurance Often Excludes Cosmetic Dentistry

Here's the question I hear almost daily at UNO DENTAL SAN FRANCISCO: "Will my insurance cover my smile makeover?" I wish I could give everyone the answer they want to hear, but the reality is more complicated.

Traditional dental insurance operates on a simple principle: they'll pay for what keeps your mouth healthy and functional, not necessarily what makes it beautiful. Insurance companies draw a clear line between procedures that are medically necessary versus those that are elective.

The "elective versus medically necessary" distinction is everything when it comes to coverage. If you need a filling to treat a cavity, that's medically necessary – your insurance will likely cover it. But if you want professional teeth whitening to brighten your smile for your wedding photos? That's considered elective, and you'll probably be paying out of pocket.

This insurance focus on prevention and restoration makes sense from their perspective. They're designed to cover cleanings that prevent disease, fillings that stop decay, and root canals that save infected teeth. These procedures protect your oral health and maintain basic function.

But here's where it gets interesting – and where you might find some coverage. Some procedures serve dual purposes, offering both cosmetic and functional benefits. This gray area is where smart planning for dental plans for cosmetic dentistry really pays off.

Take crowns, for example. If you crack a molar and need a crown to protect it from further damage, that's clearly restorative. Your insurance will typically cover 50-80% of the cost. The fact that the crown also improves the tooth's appearance is just a happy bonus.

Dental implants fall into this dual-purpose category too. While they can dramatically transform your smile, their primary job is replacing missing teeth to restore proper chewing function and prevent bone loss. Many insurance plans will offer partial coverage for implants when they're replacing teeth lost due to injury or disease – though the non-aesthetic benefits often drive the coverage decision.

The improved oral health that comes from cosmetic procedures often surprises patients. Clear aligners like Invisalign don't just straighten your smile – they make your teeth easier to clean, reducing your risk of cavities and gum disease. That increased confidence from a beautiful smile? That's just the cherry on top of better oral health.

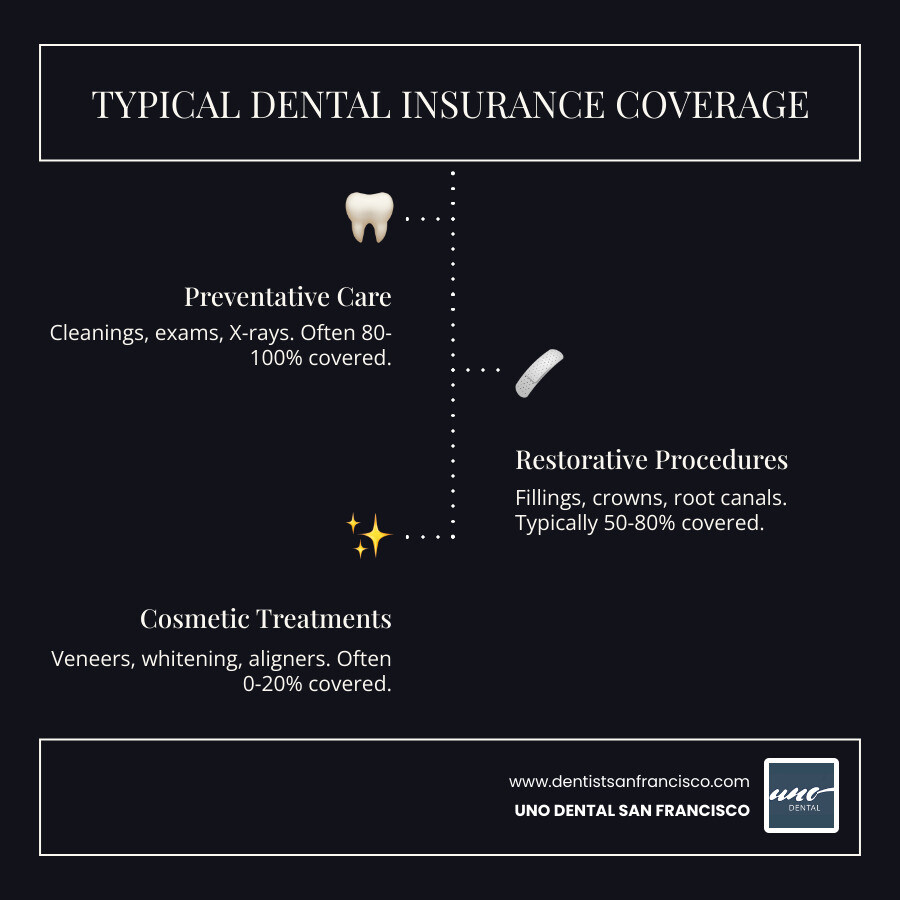

Here's how typical coverage breaks down for different types of procedures:

| Procedure Type | Examples | Typical Coverage |

|---|---|---|

| Restorative | Fillings, crowns for damaged teeth, root canals | 50-80% |

| Cosmetic | Teeth whitening, veneers for appearance only, gum contouring | 0-20% (usually 0%) |

Understanding the Costs You May Face

Cosmetic dentistry is an investment, and understanding the estimated procedure costs upfront helps you plan properly.

Teeth whitening costs typically range from $300-$1,000 for professional treatment. In San Francisco, expect costs toward the higher end of that range for results dramatically better than over-the-counter options.

Porcelain veneers costs run $800-$1,700 per tooth. Since most smile makeovers involve 6-10 veneers, it's a significant investment, but patients consistently tell me it's worth it.

Dental implant costs range from $3,000-$5,000 per tooth, including the implant, abutment, and crown. A well-placed implant can last for decades, making it a durable investment.

Clear aligner costs typically fall between $3,000-$8,000, depending on the complexity and length of your treatment. The good news is that some insurance plans offer partial coverage for orthodontics, including clear aligners.

These numbers explain why exploring all your options for dental plans for cosmetic dentistry makes such a difference. Even partial coverage or discounts can save you thousands on your smile change.

A Roundup of Dental Plans for Cosmetic Dentistry

Navigating dental plans for cosmetic dentistry can feel like solving a puzzle. While traditional insurance often falls short for smile improvements, several clever options can make aesthetic dental work more affordable. This section walks you through different plans, from PPO insurance with special riders to flexible discount programs.

Traditional PPO Insurance with Cosmetic Riders

Preferred Provider Organization (PPO) plans are usually the most flexible traditional dental insurance, letting you choose almost any licensed dentist. You'll typically save more money by visiting an "in-network" dentist who has agreed to special rates with the insurance company.

Understanding these key PPO terms is important for cosmetic work:

- Annual Maximums: The total amount your plan pays for care in a year, typically $1,000-$2,000. This can be limiting for major cosmetic work.

- Deductibles: The amount you pay out-of-pocket before your insurance begins to cover costs, often around $50 for an individual or $150 for a family annually.

- Waiting Periods: A set time after starting a plan (e.g., 6-12 months) before certain procedures are covered, which can delay cosmetic treatments.

- Pre-determination (or Pre-authorization): An essential step for costly procedures. Your dentist sends a treatment plan to your insurance, which then provides an estimate of coverage and your out-of-pocket costs. This clarifies your financial responsibility before treatment begins.

While most PPO plans don't cover purely cosmetic procedures, some rare ones might have "cosmetic riders" or cover dual-purpose procedures. Here’s what we’ve seen:

- Delta Dental PPO™ Individual Premium Plan: This unique plan offers 80% coverage for Cosmetic Services, including teeth whitening and mouth/night guards, though deductibles and annual maximums still apply.

- Aetna Dental® Direct Preferred PPO: Conversely, many Aetna Dental PPO plans explicitly exclude cosmetic procedures like teeth whitening. This highlights the importance of checking your specific policy.

It's always a good idea to check the fine print of your plan. Our team at UNO DENTAL SAN FRANCISCO can help you figure out your benefits! We're in-network preferred providers for Delta Dental Premier, Aetna, Guardian, and Level, and we accept Beam, Cigna, and MetLife as out-of-network PPO plans (sorry, no HMOs!). We love making this complex process simple for our patients.

More info about our accepted PPO plans

Dental Savings (Discount) Plans: A Flexible Alternative

If traditional insurance doesn't meet your cosmetic goals, dental savings plans are a great alternative. These are not insurance; they are membership clubs that provide discounts.

- Membership Fee: You pay a small annual fee to join.

- Percentage Discounts: In return, you get a discount (often 10-60%) on most dental procedures, including many cosmetic treatments. You pay the discounted rate directly to the dentist.

- No Waiting Periods: A huge plus! You can sign up and use your discount almost immediately.

- No Annual Limits: There's no cap on how much you can save, which is ideal for extensive cosmetic work.

- Pre-existing Conditions: These plans usually don't have restrictions for pre-existing conditions.

Providers like DentalPlans.com report that members save an average of 50%. They offer plans from trusted administrators like Careington and 1Dental that often activate within 1 to 3 business days. These plans are a game-changer if you need significant cosmetic work, have no employer-provided insurance, or are a senior on Medicare without dental coverage.

You'll find that many procedures get a nice discount, including teeth whitening, porcelain veneers, dental bonding, clear aligners, dental implants, crowns, and gum contouring.

In-House Dental Membership Plans

Many dental practices—including us at UNO DENTAL SAN FRANCISCO—offer our own "in-house" dental membership plans. These are direct-to-dentist plans designed for patients without traditional insurance or whose coverage is insufficient.

How they work:

- Annual Fee: You pay one simple annual fee directly to our practice.

- Included Preventative Care: This fee typically covers routine care like yearly exams, regular cleanings, and necessary X-rays.

- Discounts on Cosmetic Work: Members also get significant discounts on other treatments, including cosmetic procedures like veneers, whitening, and clear aligners. This provides clear pricing and immediate savings without the headaches of deductibles, annual maximums, or waiting periods.

These plans simplify the financial side of your dental care, allowing you to budget more easily and access the cosmetic treatments you want without surprises. It’s a straightforward way to manage your dental health and get the confident smile you deserve.

Learn about our Gleambar Membership

Financing the Gap: Paying for What Plans Don't Cover

Even with the best dental plans for cosmetic dentistry or discount programs, there might still be a gap between what's covered and your total treatment cost. This is especially true for extensive cosmetic changes like full smile makeovers or multiple veneers. But here's the good news: you have several excellent financing options that can make your dream smile surprisingly affordable.

Let me walk you through the most popular ways our patients bridge this financial gap. Over the years, I've seen these options transform what seemed like impossible dreams into achievable realities.

Third-party financing has become a game-changer for cosmetic dentistry. These specialized credit lines are designed specifically for healthcare expenses, allowing you to spread costs over time with manageable monthly payments.

CareCredit is probably the most well-known option in this space. Think of it as a credit card exclusively for health, wellness, and beauty needs. What makes it particularly attractive are the promotional periods - you can often get 6, 12, 18, or even 24 months with zero interest if you pay off the full balance within that timeframe. For longer treatment plans, they also offer fixed interest rate options that give you predictable monthly payments.

LendingClub Patient Solutions takes a different approach by offering personal loans specifically for medical procedures. Once approved, the funds go directly to you or our practice, giving you a clear monthly payment schedule with a fixed interest rate. This can be especially helpful for larger cosmetic treatments where you want the certainty of knowing exactly what you'll pay each month.

Explore LendingClub Patient Solutions

Many patients don't realize that payment plans directly through our practice can be one of the most straightforward options. At UNO DENTAL SAN FRANCISCO, we understand that everyone's financial situation is unique. That's why we offer flexible in-house payment arrangements that let you pay for your treatment in installments directly to our office.

The beauty of this approach is its simplicity - no third-party applications, no credit checks, and no complicated terms. We work with you to create a payment schedule that fits comfortably within your budget. It's a direct, no-fuss way to manage costs while maintaining the personal relationship we value with our patients.

If you have access to a Health Savings Account (HSA) or Flexible Spending Account (FSA) through your employer, you're sitting on a goldmine for dental expenses. These tax-advantaged accounts let you use pre-tax dollars for qualified medical and dental expenses, effectively giving you an immediate discount equal to your tax rate.

HSAs are available with high-deductible health plans and offer triple tax benefits - your contributions are tax-deductible, the money grows tax-free, and withdrawals for qualified expenses are tax-free too. Even better, HSA funds roll over year after year, so you can save up for that smile makeover over time.

FSAs work similarly but are typically paired with traditional health plans. While they usually have a "use it or lose it" rule at year-end, many plans now offer grace periods or limited rollover options. The key advantage is that FSA contributions reduce your taxable income right away.

Both HSA and FSA funds can cover a wide range of dental treatments. While purely cosmetic procedures might not qualify, many treatments we consider "cosmetic" actually have functional benefits that make them eligible. Our team provides detailed, itemized invoices that help you properly document these expenses for your tax-advantaged accounts.

The secret to successful cosmetic dentistry financing is often combining multiple approaches. You might use your dental savings plan for an immediate discount, pay part of the remaining balance with HSA funds, and finance the rest through CareCredit's promotional period. This layered approach can make even extensive smile makeovers surprisingly affordable.

Frequently Asked Questions about Cosmetic Dentistry Coverage

It's totally normal to have questions when you're thinking about investing in your smile! We hear a lot of similar concerns from our patients about how to make cosmetic dentistry affordable. Here are some of the most common questions we get, and our straightforward answers:

Can I get a dental plan that specifically covers veneers or teeth whitening?

Wouldn't that be nice? The honest truth is, finding a dental plan for cosmetic dentistry that fully covers procedures like veneers (when they're just for looks) or teeth whitening is pretty rare. Most standard dental insurance plans consider these treatments "elective." That's a fancy way of saying they're chosen for appearance, not because your mouth needs them to stay healthy.

However, there's a little wiggle room sometimes! If a procedure that looks cosmetic also helps your teeth function better or keeps them healthy, you might get some partial coverage. For example:

- If you have a severely chipped tooth, a veneer might not just make it look good, but also protect it from further damage. In cases like this, it's not purely cosmetic anymore, and your insurance might chip in a little.

- Or, if a discolored tooth is due to a health issue (like an old injury or infection), and treating the discoloration is part of a bigger plan to restore the tooth's health, there could be some coverage.

It's super important to dig into your specific plan details. Some rare premium plans, like the Delta Dental PPO™ Individual Premium Plan we talked about earlier, might surprise you with a percentage of coverage for certain cosmetic services. But generally, it's best to assume that purely aesthetic procedures will be out-of-pocket. Any coverage you get would be a nice bonus after we check with your plan!

Are dental savings plans better than insurance for cosmetic work?

This is a fantastic question, and the answer really depends on what you're looking for! When it comes to dental plans for cosmetic dentistry, savings plans and traditional insurance serve different purposes.

Dental savings plans often shine brightest if you're planning on more extensive cosmetic work. Think of them like a membership club: you pay a yearly fee, and in return, you get immediate discounts (often 10-60%) on most dental procedures. The big perks here are: no annual limits (so you can save on as much work as you need!), no deductibles, and usually no waiting periods. This means you could sign up today and start your smile change tomorrow, saving money right away. They're especially helpful for big projects like multiple veneers or dental implants, where traditional insurance's annual maximums would quickly run out.

Dental insurance, on the flip side, is usually fantastic for preventative care (like your regular cleanings and check-ups) and often covers a good chunk of basic and major restorative work (like fillings or crowns for damaged teeth). But for cosmetic procedures, its coverage is usually very limited, if it exists at all.

So, for a clear cost-benefit analysis focused specifically on cosmetic dentistry, dental savings plans often win out. They offer direct, upfront savings without all the red tape of waiting periods or annual caps. If a beautiful new smile is your main goal, a savings plan can make a big difference in your budget.

How do I know if my procedure will be covered?

This is the million-dollar question, and it's totally understandable to want clarity before starting any dental work! The best way to get a clear picture of what your plan might cover is through something called pre-determination or pre-authorization. Think of it as asking for an estimate from your insurance company before treatment begins.

Here's how we recommend you approach it:

- Let Our Team Help You: At UNO DENTAL SAN FRANCISCO, we're pros at navigating dental insurance. Once we've chatted about your smile goals and created your personalized treatment plan, we can submit a pre-determination request to your insurance provider for you. We'll send them all the details: the proposed procedures, special codes, and estimated costs.

- Wait for the "Explanation of Benefits" (EOB): Your insurance company will review our request. Then, they'll send you an "Explanation of Benefits" (EOB) form. This EOB will outline what they expect to cover, what your estimated out-of-pocket cost will be, and if there are any waiting periods or limitations you need to know about. This is an estimate, not a guaranteed payment, but it's the closest thing you'll get to a definitive answer before treatment starts.

- Understand the "Alternate Benefit Clause": Sometimes, insurance plans have a rule called the "Alternate Treatment Rule" or "Alternate Benefit Clause." This simply means that if there are a few ways to fix a problem, your insurer might only cover the cost of the least expensive option that's still medically sound. For example, if you want a beautiful porcelain crown on a back molar for cosmetic reasons, but a less expensive metal crown would work just fine to restore its function, they might only cover the cost of the metal crown. We'll explain if this applies to your situation.

- Good Documentation is Key: We'll make sure to provide thorough documentation, including X-rays and detailed notes, especially if any cosmetic procedure also has a functional or restorative benefit. This helps support your claim for partial coverage.

By following these steps, you'll have a much clearer understanding of your financial responsibility before you start on your journey to a more confident and beautiful smile.

Your Path to a Confident Smile

After everything we've covered about dental plans for cosmetic dentistry, you might feel like you've just learned a new language. But here's the truth: achieving your dream smile isn't as complicated as it might seem. It just requires a bit of planning and knowing where to look.

Let's be honest about what we've finded. Standard insurance often treats cosmetic procedures like luxury items – nice to have, but not essential. That means procedures like teeth whitening, veneers for purely aesthetic reasons, and clear aligners might come entirely out of your pocket. But remember, some treatments that improve your smile also serve functional purposes, and those might qualify for partial coverage.

The numbers we've shared – from $300 for basic teeth whitening to $8,000+ for comprehensive clear aligner treatment – aren't meant to scare you. They're meant to help you plan. When you know what you're facing financially, you can make informed decisions about timing and financing.

The real game-changer is combining different approaches. Maybe you use a dental savings plan to get 30% off your veneers, then spread the remaining cost over 18 months with CareCredit. Or perhaps you maximize your FSA contributions this year to cover your teeth whitening, while using our Gleambar Membership for ongoing preventative care and discounts on future cosmetic work.

We've seen patients get creative with their financing. One patient saved for six months while using professional whitening trays to improve their smile in the meantime. Another used their tax refund combined with a payment plan to get the veneers they'd been dreaming about for years. Proactive planning makes almost any smile goal achievable.

At UNO DENTAL SAN FRANCISCO, we've guided hundreds of patients through this exact process over our 15+ years of practice. We know that discussing money can feel awkward, but we believe in complete transparency. That's why we'll sit down with you to review your insurance benefits, explain your out-of-pocket costs, and help you explore every financing option available.

Your smile change doesn't have to happen overnight. Sometimes the best approach is phased treatment – starting with the procedures that will make the biggest impact, then adding others as your budget allows. We're here to help you create a timeline that works for your life and your wallet.

Our free virtual smile consultation is where many patients start their journey. You can discuss your goals, ask questions about costs, and get a feel for what's possible – all from your couch. No pressure, no surprises, just honest conversation about how to make your smile dreams a reality.

In the heart of San Francisco, where everything seems expensive, we're committed to making quality cosmetic dentistry accessible. Because when you love your smile, it shows in everything you do.