Understanding Health Insurance That Covers Cosmetic Dentistry

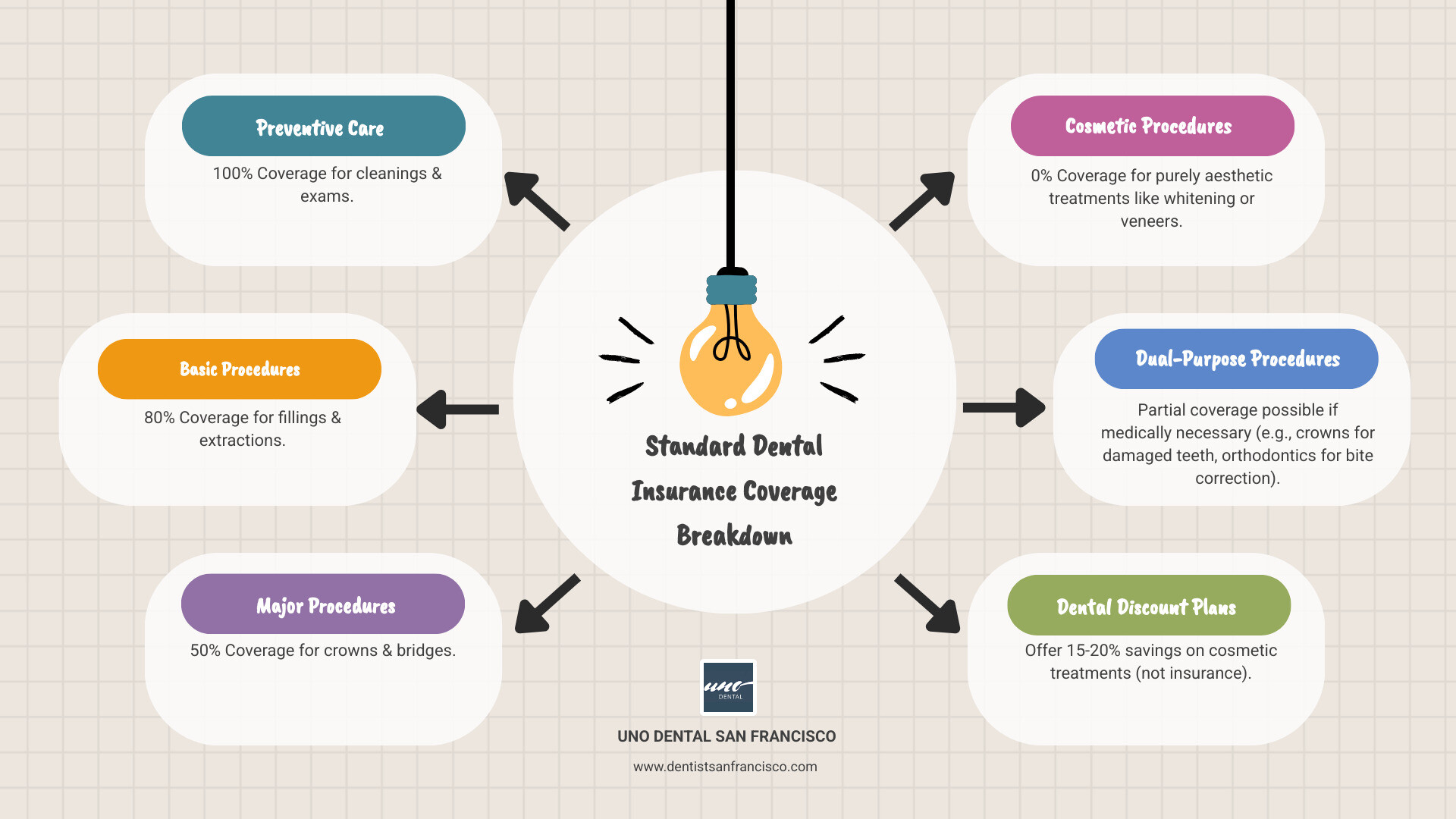

Health insurance that covers cosmetic dentistry is rare because most plans classify these procedures as elective rather than medically necessary. Standard dental insurance typically covers 0% of purely cosmetic treatments like teeth whitening or veneers. However, some procedures may qualify for partial coverage if they also restore function, such as a crown on a broken tooth.

Most dental plans follow a tiered coverage model: 100% for preventive care, 80% for basic procedures, and 50% for major work. Cosmetic dentistry usually sits outside this structure. Understanding this distinction is the first step to planning your smile improvement. Even when insurance doesn't help, alternative financing options can make your dream smile achievable.

At UNO DENTAL SAN FRANCISCO, Dr. Mohammad Aghiad Kandar and our team help patients steer the complexities of dental insurance. With over 15 years of experience, we create customized treatment plans that maximize your benefits while exploring all available financing options. Our goal is to make your smile change accessible, regardless of insurance limitations.

Learn more about health insurance that covers cosmetic dentistry:

- cosmetic dentistry with payment plan

- dental insurance that covers veneers

- dental payment plan options

Defining the Divide: Cosmetic vs. Medically Necessary Dentistry

Understanding why health insurance that covers cosmetic dentistry is rare begins with how insurance companies classify dental work. At UNO DENTAL SAN FRANCISCO, we help patients understand this distinction, as it's key to managing expectations and budgeting for treatment.

Cosmetic dentistry focuses on improving your smile's appearance, while medically necessary dentistry protects your oral health and function. Insurance companies prioritize function over appearance. If a procedure treats disease, restores chewing ability, or relieves pain, it's more likely to be covered. If it's mainly about aesthetics, you'll likely pay out-of-pocket.

What is Cosmetic Dentistry?

Cosmetic dentistry involves elective treatments to improve your smile's appearance and boost confidence. According to the American Academy of Cosmetic Dentistry, these procedures create positive changes to your teeth and smile.

Common treatments include:

- Teeth whitening: Brightens your smile by removing stains.

- Dental veneers: Thin porcelain shells that transform a tooth's color, shape, or size.

- Dental bonding: Tooth-colored resin used to repair chips, cracks, or gaps.

- Gum contouring: Reshapes the gum line for a more balanced smile.

- Smile makeovers: A combination of treatments for a total smile change.

While these procedures provide a significant confidence boost, insurance companies classify them as wants, not needs.

General and Restorative Dentistry: The Insurance Favorite

General and restorative dentistry addresses oral health problems, prevents disease, and restores function. These treatments are necessary to keep your mouth healthy. This category includes services that are essential for maintaining your oral health.

Examples include:

- Fillings to repair cavities.

- Root canals to save infected teeth.

- Crowns to rebuild severely damaged teeth.

- Extractions to remove teeth that are beyond saving.

- Periodontal treatment to fight gum disease.

These procedures focus on treating disease and restoring function—the exact criteria insurance companies use to determine coverage. Because they are not cosmetic choices, insurance is more likely to help with the costs, drawing a hard line at purely aesthetic improvements.

The Reality of Finding Health Insurance That Covers Cosmetic Dentistry

Searching for health insurance that covers cosmetic dentistry can be frustrating. The reality is that dental insurance is designed to cover medically necessary treatments, not elective cosmetic procedures. Standard plans almost never cover work done purely for aesthetics.

Even when there's a chance of coverage, you'll face limitations like annual maximums (often just $1,000-$2,000) and waiting periods. At UNO DENTAL SAN FRANCISCO, we help patients steer this landscape to make their smile goals achievable.

Why Standard Dental Insurance Says No

The reason is medical necessity. Insurance is built to protect against health crises and maintain function, not to improve appearance. Cosmetic procedures are considered elective, so insurers exclude them to keep premiums affordable for essential care. As we often explain to patients asking, "Will My Dental Insurance Cover Cosmetic Dentistry?", the answer is rarely a simple yes.

Are There Specific Plans or Riders for Cosmetic Coverage?

While comprehensive cosmetic coverage is rare, a few limited options exist:

- Supplemental cosmetic riders: These add-ons to premium plans may offer a small percentage of coverage but come with waiting periods, low maximums, and many exclusions.

- High-tier dental plans: Some top-level plans include minimal cosmetic benefits, but they are often too restricted to be useful.

- Dental discount plans: These membership programs are not insurance. You pay an annual fee for access to a network of dentists offering reduced rates (often up to 20%) on many services, including cosmetic procedures like veneers and dental implants. They have no waiting periods or annual maximums.

- Employer-specific benefits: Some large companies negotiate unique benefits that may include a small cosmetic allowance, but this is uncommon.

For more information, see our guide to Dental Plans for Cosmetic Dentistry.

Which Procedures Might Get Partial Coverage?

Some treatments exist in a gray area where cosmetic and functional benefits overlap. This is the best opportunity for partial coverage.

- Dental bonding: If used to repair a chipped tooth from an accident, dental bonding may be partially covered as a restorative procedure.

- Crowns: When needed to restore a tooth damaged by decay or trauma, crowns are typically covered at about 50% as a major procedure.

- Dental implants: Coverage is increasing, especially in employer-sponsored plans. Implants restore chewing function and prevent bone loss, often qualifying for 50% coverage.

- Orthodontics: Braces or clear aligners may be covered, especially with an add-on rider, if they correct a functional bite issue.

| Procedure | Primary Classification | Coverage Likelihood | What You Should Know |

|---|---|---|---|

| Teeth Whitening | Cosmetic | Very Low/None | Almost never covered; purely aesthetic |

| Veneers | Cosmetic | Very Low/None | Rarely covered unless significant damage exists |

| Bonding for chips | Cosmetic/Restorative | Low to Medium | May get partial coverage if functional need is documented |

| Crowns for decay | Restorative | High | Typically 50% coverage under major procedures |

| Dental Implants | Restorative | Medium to High | Often 50% coverage; may improve with enrollment length |

| Orthodontics | Restorative/Cosmetic | Medium | Usually requires rider; better coverage for functional corrections |

| Gum Contouring | Cosmetic | Very Low/None | Aesthetic procedure with minimal functional component |

At UNO DENTAL SAN FRANCISCO, our team understands these nuances. We work to structure your treatment plan to maximize any available benefits, handling documentation and pre-treatment estimates to advocate for you.

The Crossover: When Procedures are Both Functional and Aesthetic

Some dental procedures are both functional and aesthetic, creating an opportunity to get partial health insurance that covers cosmetic dentistry. These dual-purpose treatments are your best chance for coverage.

A dental crown, for example, protects a cracked tooth (functional) while also being crafted to look beautiful (aesthetic). Dental implants restore your ability to eat and prevent bone loss (functional) while completing your smile (aesthetic). The key to open uping coverage is thorough documentation of the medical necessity and getting pre-authorization from your insurer.

The "Medically Necessary" Gray Area

Several procedures live in this gray area where function meets aesthetics:

- Accident or injury repair: Work to fix a chipped or broken tooth, whether it's cosmetic dental bonding or a crown, is often considered medically necessary to restore tooth structure.

- Replacing old, failing restorations: When an old filling is cracking, replacing it with a modern, tooth-colored one is restorative care, even though it looks better.

- Correcting bite issues: Orthodontics may qualify for coverage if misalignment causes jaw pain, chewing difficulty, or uneven tooth wear.

- Improving chewing function: Procedures like implants, bridges, and crowns restore your ability to eat properly. Dental implants, for instance, provide a strong foundation for replacement teeth, highlighting their functional importance.

How Your Dentist Can Help Maximize Benefits

At UNO DENTAL SAN FRANCISCO, we are skilled at navigating the insurance maze for our patients. We know how to present your case to highlight its medical necessity.

- Detailed Treatment Plans: We create comprehensive plans that justify each procedure for your oral health.

- Diagnostic Records: We use digital X-rays and iTero scanners to provide concrete evidence of damage, decay, or bite issues that require treatment.

- Pre-Treatment Estimates: Before you commit, we send a plan to your insurer to get an estimate of what they'll cover, so you have a clear financial picture.

- Phasing Treatment: We can sometimes spread procedures across two plan years to help you use your annual maximum twice, reducing your out-of-pocket costs.

We help you understand which parts of your treatment plan might qualify for insurance and which are cosmetic investments. Our team advocates for you, working to secure every dollar of coverage you're entitled to. Learn more about the possibilities by exploring "What Can Cosmetic Dentistry Do?."

Navigating Your Coverage and Out-of-Pocket Costs

Even though health insurance that covers cosmetic dentistry is uncommon, smart financial planning can make your dream smile achievable. At UNO DENTAL SAN FRANCISCO, we are committed to cost transparency, so you can feel confident in your financial decisions.

How to Check Your Plan for health insurance that covers cosmetic dentistry

Understanding your policy is easier than you think. Here's how to start:

- Read your Evidence of Coverage (EOC): This document is your plan's rulebook. Look for sections on "cosmetic procedures," "elective treatments," or "exclusions."

- Call your insurance provider: This is often the fastest way to get clear answers. Ask about coverage for specific procedure codes, your annual maximum, and any waiting periods.

- Let our team help: At UNO DENTAL SAN FRANCISCO, our staff works with insurance companies daily. We are in-network with several major PPO plans and work with many others out-of-network. We can help interpret your benefits and submit pre-treatment estimates. (We do not accept HMO plans).

- Review past claims: Your Explanation of Benefits (EOB) statements show how your insurance handled previous procedures, offering clues for future treatments.

Understanding the Cost of Cosmetic Dentistry upfront is key to making informed decisions.

Alternative Ways to Pay for Your Dream Smile

Even without insurance coverage, several flexible financing options can make treatment manageable.

- In-house dental payment plans: We work with you to create a payment schedule that fits your budget, breaking the total cost into manageable installments.

- Third-party financing: Companies like CareCredit and LendingClub specialize in healthcare financing and offer plans with promotional zero-interest periods.

- HSA/FSA: Your Health Savings Account (HSA) or Flexible Spending Account (FSA) lets you use pre-tax dollars for healthcare. Dual-purpose procedures like crowns or implants often qualify.

- Dental discount plans: These membership programs provide access to reduced fees on a wide range of services, including cosmetic treatments, for an annual fee.

We are committed to Making Dental Care Affordable. Our team will discuss all these options to create a financial plan that works for you.

Frequently Asked Questions about Cosmetic Dentistry Insurance

At UNO DENTAL SAN FRANCISCO, we frequently answer questions about health insurance that covers cosmetic dentistry. Here are clear answers to some of the most common concerns.

Does "full coverage" dental insurance include cosmetic procedures?

No. The term "full coverage" is misleading. It refers to a broad range of necessary preventive, basic, and major restorative services, not elective cosmetic work. Even plans that cover 100% of cleanings will typically offer 0% for treatments like teeth whitening. Always check your policy's specific exclusions for cosmetic procedures.

Can I get veneers covered if my teeth are chipped?

This is a classic "it depends" scenario. Coverage depends on the severity of the chip and the required repair.

- Bonding: If the chip can be repaired with dental bonding, your insurance may cover it as a restorative procedure to protect the tooth.

- Veneers: Veneers are primarily cosmetic and less likely to be covered. However, if a veneer is deemed the most appropriate restorative option for a significantly damaged tooth, partial coverage may be possible with strong documentation.

- Crowns: For severely fractured teeth, a crown is a medically necessary solution and is often covered as a major restorative procedure (typically around 50%).

The key is whether the treatment's primary purpose is to restore health and function. For more details, see our guide on Dental Insurance That Covers Veneers.

Are dental discount plans a good alternative for cosmetic work?

Yes, they can be an excellent alternative. Dental discount plans are not insurance; they are membership programs. You pay an annual fee (e.g., $100-$200) for access to a network of dentists who offer services at a reduced fee, often 15-20% off.

The main advantages are that they often include cosmetic treatments that insurance excludes, and they typically have no deductibles, annual maximums, or waiting periods. This makes them a straightforward way to reduce your out-of-pocket costs for cosmetic procedures.

Conclusion: Investing in Your Smile and Well-being

The reality is that health insurance that covers cosmetic dentistry is rare. Most dental plans draw a firm line between medically necessary care and elective cosmetic improvements. However, this shouldn't stop you from achieving the smile you've always wanted.

Investing in your smile is an investment in yourself. A confident smile can boost your self-esteem, improve social interactions, and motivate better oral hygiene. The value of a smile you love extends far beyond what any insurance policy can measure. Furthermore, many cosmetic procedures also provide functional benefits, making them a valuable investment in your overall health.

While insurance coverage is limited, your options for achieving your dream smile are not. At UNO DENTAL SAN FRANCISCO, we make quality dental care accessible through:

- Flexible in-house payment plans

- Third-party financing like CareCredit and LendingClub

- Help maximizing any existing insurance benefits for dual-purpose procedures

Our team, led by Dr. Mohammad Aghiad Kandar, is committed to creating individualized treatment plans that fit your goals and budget. We use high-tech dentistry to ensure precise, effective care and are always transparent about costs.

Your smile is worth it. The confidence and joy that come from smiling without hesitation are benefits that last a lifetime. We have helped countless patients steer the financial aspects of cosmetic dentistry, and we are ready to help you.

Ready to take the first step? Explore your options for cosmetic dentistry with us today. Let's create a plan that brings your dream smile within reach.

Reviewed by: Dr. Mohammad Aghiad Kandar and the UNO DENTAL SAN FRANCISCO clinical team.